KEY POINTS:

- The big five banks all think that we’re close to the bottom of the OCR/mortgage rate cycle.

- ANZ and Kiwibank think the OCR will be cut to 2.5%; BNZ forecast 2.75%; ASB and Westpac think the OCR will bottom out at 3%.

- As a result, short-term rates under one year have a little further to fall over the second half of 2025.

- Longer fixed rates likely to remain at current levels throughout 2026, until economy strengthens.

Between November 2021 and May 2023, the Reserve Bank (RBNZ) lifted the Official Cash Rate (OCR) from its all-time low of 0.25% to 5.50% – a level not seen since before the GFC, in 2008.

As a result, these increases in the cost of borrowing flowed through to mortgage rates. In August 2021, the average one-year fixed rate for owner-occupiers on Canstar’s mortgage database was 2.58%. And by January 2024, it was 7.5%.

But, thankfully, peak mortgage pain has passed. Since last August, the RBNZ has cut the OCR six times, from 5.5% to 3.25%, and banks have reduced their mortgage rates.

At time of writing (18/07/25), the average one-year fixed rate on Canstar’s database is 4.97%, and over the past 12 months average fixed rates across one to three years have dropped around 170 basis points (bps).

But whereto from here?

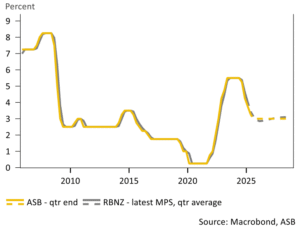

When it made its most recent announcement, on July 9, although it held the OCR steady, the RBNZ said that it expects to lower the OCR further, consistent with its May forecast, which suggests another 40bps of cuts, to a low of around 2.85% for most of next year.

RBNZ OCR Forecast

![]()

So given the RBNZ’s forecast of further OCR cuts, and the continuing global economic uncertainty, what are the major banks predicating for the OCR and mortgage rates over the coming months? Let’s take a look.

Below are synopses of the major banks’ outlooks. Click on each bank’s name to jump to a more detailed overview of its predictions. And click here to see where, historically, mortgage rates have sat in relation to the OCR.

- ANZ: Expects more cuts to the OCR to take it to a low of 2.5% by October, where it will remain until the end of 2026. Says wholesale and market rates have a little further to fall, but from there the only way is up, and that homeowners should start to consider longer-term rates.

- ASB: Predicts that, this year, the RBNZ will make one more cut to the OCR, taking it to 3% in August. For those with mortgages it says that floating or fixing for the six-month term is an expensive place to be borrowing if you’re waiting for lower long-term rates, because they’re not likely to fall much further and could start to rise by the end of the year.

- BNZ: Is sticking with its forecast that the OCR will hit a low of 2.75% by the end of the year. This means that longer-term fixed mortgage rates have already bottomed out. Only shorter-term rates – six-month and one-year fixed mortgage rates – are likely to dip lower, into the 4.5% to 5% range.

- Kiwibank: Thinks the RNBZ needs to cut the OCR to 2.5% by the end of the year, due to the weak economy. If that happens, says wholesale and retail rates have further to fall. However, if the RBNZ doesn’t cut that low, and sticks at 2.75%, mortgage rates aren’t likely to rise, and will remain static.

- Westpac: OCR to bottom out at 3% in August. As a result, longer-term rates now pretty much as low as they’re going to go. Short-term mortgage rates still have a little way to fall, but fixing shorter than a year is a bet that the OCR is going to go sub-2.75%, which Westpac thinks is unlikely.

Lowest Mortgage Rates for Refinancing

Looking to refinance your mortgage? The table below displays some of the one-year fixed-rate home loans on our database (some may have links to lenders’ websites) that are available for home owners looking to refinance. This table is sorted by current interest rates (lowest to highest), followed by company name (alphabetical). Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstar’s home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

Compare Lowest Home Loan Rates for Refinancing

ANZ

The ANZ predicts two more OCR cuts this year (in August and October) taking it to a low of 2.5%, where it will remain until the end of 2026, when it will move back up to a neutral level of 3%.

ANZ Projected OCR Rates

| September 2025 | December 2025 | March 2026 | June 2026 | September 2026 | December 2026 |

| 2.75% | 2.50% | 2.50% | 2.50% | 2.50% | 3.00% |

As a result, ANZ thinks that we’re nearing the low point in the interest rate cycle, and that wholesale rates will bottom out around the end of the year and that one- to two-year mortgage rates have the capacity to fall by between 10-20bps.

Therefore the bank thinks that “there is merit in fixing for six months, with a view to re-fixing for a longer term when that fixed term ends later in the year”. However, it adds that because of the continuing economic uncertainty, it’s a slightly riskier strategy than just fixing for one or two years, where rates are cheapest.

As a consequence, if you’ve a mortgage, it says that it’s worth considering splitting your mortgage into chunks and fixing them across a mix of terms.

ANZ Projected Special Interest Rates

| Interest Rates | September 2025 | December 2025 | March 2025 | June 2026 | September 2026 | December 2026 |

| Floating | 6.0% | 5.9% | 5.9% | 5.9% | 5.9% | 6.4% |

| 1-Year | 4.7% | 4.8% | 4.9% | 5.1% | 5.2% | 5.2% |

| 2-Year | 4.9% | 4.9% | 5.0% | 5.1% | 5.2% | 5.3% |

| 3-Year | 5.0% | 5.1% | 5.2% | 5.3% | 5.4% | 5.4% |

| 5-Year | 5.5% | 5.5% | 5.6% | 5.6% | 5.7% | 5.7% |

Source: RBNZ, ANZ Research

ASB

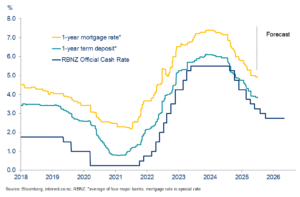

The ASB predicts that, this year, the RBNZ will make one more cut to the OCR, taking it to 3% in August.

For those with mortgages it says that it’s a question of “a bird in the hand or two in the bush”?

The bank says that, based on its economic forecasts: “floating or fixing for the shortest six-month term is an expensive place to be borrowing, while some of the fixed terms are now at or near the lows we expect”.

So, if you’ve a mortgage, do you take advantage of already low long-term rates, which could start to rise by the end of the year? Or do you take a punt on a shorter-term rate hoping that longer-term rates dip slightly lower, which they might not?

The answer, the ASB says, is not about trying to predict the bottom of the interest rate cycle. Rather, it’s to fix your mortgage to your financial needs – which includes your tolerance to any interest rate hikes and your flexibility – as well as securing the lowest possible rates.

ASB OCR Forecast July 2025

Searching for the Cheapest Personal Loan?

If you’re looking for the cheapest personal loan, Canstar’s personal loan comparison tables can help. The table below displays the sponsored unsecured personal loan products available on Canstar’s database for a three-year loan of $10,000 in Auckland, with links to lenders’ websites. Use Canstar’s personal loan comparison selector to view a wider range of products on Canstar’s database. Canstar may earn a fee for referrals.

BNZ

The BNZ is sticking with its forecast that the RBNZ will cut the OCR to a low of 2.75% by the end of the year. But adds that: “the rate cutting cycle appears to be entering its final stage”.

This means that unless there’s big shock to the economy, longer-term fixed mortgage rates have already bottomed out. And only shorter-term rates – six-month and one-year fixed – are likely to dip lower, perhaps another 20-40bps of downside, into the 4.5% to 5% range over the second half of the year.

BNZ OCR & Interest Rates Forecast July 2025

Kiwibank

Kiwibank’s economists have long called for a lower OCR, and they are blunt about what they think the RBNZ should do in the face of the weakness of the NZ economy: cut the OCR to 2.5%.

To that end, Kiwibank is forecasting another 25bp cut in August, followed by further cuts to take the OCR to 2.5% by the end of the year, which will mean more rate relief for mortgaged households.

But this could be wishful thinking on the part of Kiwibank, and it notes that wholesale markets and the RBNZ both have different forecasts about where the OCR will end up.

It says that the market has already priced in just one more cut, to 3%, and if that turns out to be the case, mortgage rates are have already dipped as low as they’re going to go.

Meanwhile, if the RBNZ’s predictions are correct, and it cuts the OCR to around 2.75%, Kiwibank thinks that mortgage rates will be tweaked only ever so slightly.

Compare Travel Money Cards

Headed off overseas and looking for the best in money cards? Here’s a rundown of some of the most popular cards in New Zealand:

The display order does not reflect any ranking or rating by Canstar. This information is not an endorsement by Canstar of travel money cards or any specific provider. Information correct as of 14/04/25. For full pricing details see individual providers’ websites. *Weekend fee will apply outside exchange market hours if it is made between Friday 5pm (New York time) and Sunday 6pm (New York time), which is a US based time zone

Westpac

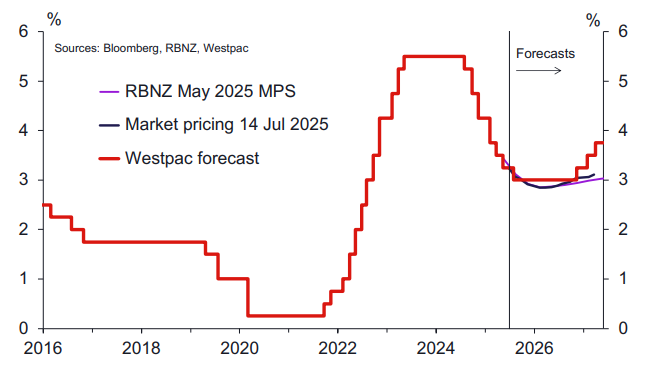

Westpac is forecasting the OCR to bottom out at 3%, with the next cut in August. However, it doesn’t foresee interest rates to go much lower.

It says that mortgage rates might fall slightly, due to bank competition or if wholesale rates remain at current levels. But says that longer-term rates, especially two- and three-year fixed rates, are attractive as they’re currently under 5%.

Westpac thinks that shorter term rates may fall slightly if the RBNZ cuts the OCR further, but that fixing shorter than a year is a bet that the OCR is going to go sub-2.75%, which Westpac thinks is unlikely.

Westpac OCR Forecast July 2025

Mortgage Rates vs OCR

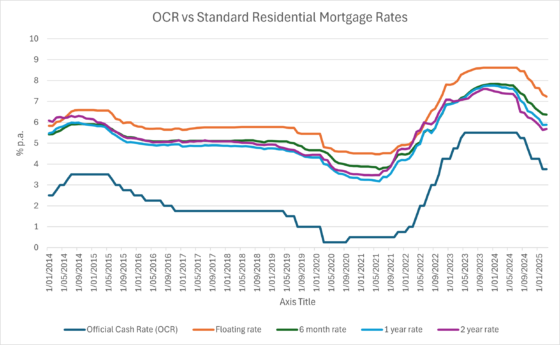

As you can see from the graph below, in the five years in the lead-up to the pandemic, mortgage rates were pretty stable, as was the OCR, which sat around 2%. During the same period, one-year mortgage rates were around 5% and two-year terms around 5.3%.

Looking at banks’ predictions, they see the OCR settling between 3% and 3.75% over the next two years. So on those forecasts, where can we expect interest rates to settle?

If we take a rough mid-point of 3.5%, the last time the OCR was at a stable 3.5% was in the period from July 2014 to May 2015, and during that time the average one-year rate was approx 5.9%, and the average two-year mortgage rate was 6.1%.

These are the banks’ standard carded rates, so if you’ve a 20%-plus deposit and a good credit history, you’re very likely to qualify for a lower special rate.

But, ultimately, while the OCR is coming down, along with mortgage rates, it’s important to remember that the ultra-low rates that some lucky homeowners managed to lock in during the pandemic were outliers, and that the historical, average one- and two-year mortgage rates of between 5% and 6% are likely to be the future, too.

About the author of this page

In his role at Canstar, he has been a regular commentator in the NZ media, including on the Driven, Stuff and One Roof websites, the NZ Herald, Radio NZ, and Newstalk ZB.

Away from Canstar, Bruce creates puzzles for magazines and newspapers, including Woman’s Day and New Idea. He is also the co-author of the murder-mystery book 5 Minute Murder.

Share this article