Since last August, the Reserve Bank (RBNZ) has cut the OCR six times. It now stands at 3.25%, and the RBNZ’s forecasts reveal that it could decline further, dipping below 3% for most of next year.

In response, all the banks have trimmed their mortgage rates. At the start of July 2024, the average one-year fixed rate for owner-occupiers on Canstar’s mortgage database was 7.18%. It now stands at 5%.

But there remains a wide disparity between rates. For example, fixed rates start as low as 4.85%, while variable rates top out at 6.89%.

So if you’re looking for the lowest mortgage rate, it’s essential to do you homework and shop around.

Compare with Canstar for the Lowest Mortgage Rates

And one of the best places to start your hunt for the lowest mortgage rate is Canstar’s home loan database, ratings and awards. Not only can you compare over 200 different mortgage products from 10 lenders, you can discover which loans and lenders earn Canstar’s top awards for value and service, as judged by our expert research panel.

The table below displays some of the 1-year fixed-rate home loans on our database (some may have links to lenders’ websites) that are available for home owners. This table is sorted by current interest rates (lowest to highest), followed by company name (alphabetical). Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstar’s home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

Compare Lowest Home Loan Rates for Refinancing

Lowest Mortgage Rates for First Home Buyers

The table below displays some of the 1-year fixed-rate home loans on our database (some may have links to lenders’ websites) that are available for first home buyers. This table is sorted by current interest rates (lowest to highest), followed by company name (alphabetical). Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstar’s home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

Compare Lowest Home Loan Rates for FHBs

Latest Owner-Occupier Mortgage Rates

Here is an overview of the current average, minimum and maximum rates for owner-occupier home loans on our database:

| Owner-Occupier Mortgage Rates | |||||||

|---|---|---|---|---|---|---|---|

| Floating | 1-Year Fixed | 2-Year Fixed | 3-Year Fixed | 4-Year Fixed | 5-Year Fixed | ||

| Average | 6.46% | 5.00% | 5.02% | 5.23% | 5.61% | 5.68% | |

| Min | 5.95% | 4.85% | 4.95% | 4.99% | 5.39% | 5.39% | |

| Max | 6.89% | 5.55% | 5.55% | 5.75% | 5.99% | 5.99% | |

Rate statistics, as at June 27, 2025

Source: www.canstar.co.nz. Based on owner-occupier loans available for $500,000, at 80% LVR and principal & interest repayments; excluding first home buyer only and green only loans in Canstar’s database.

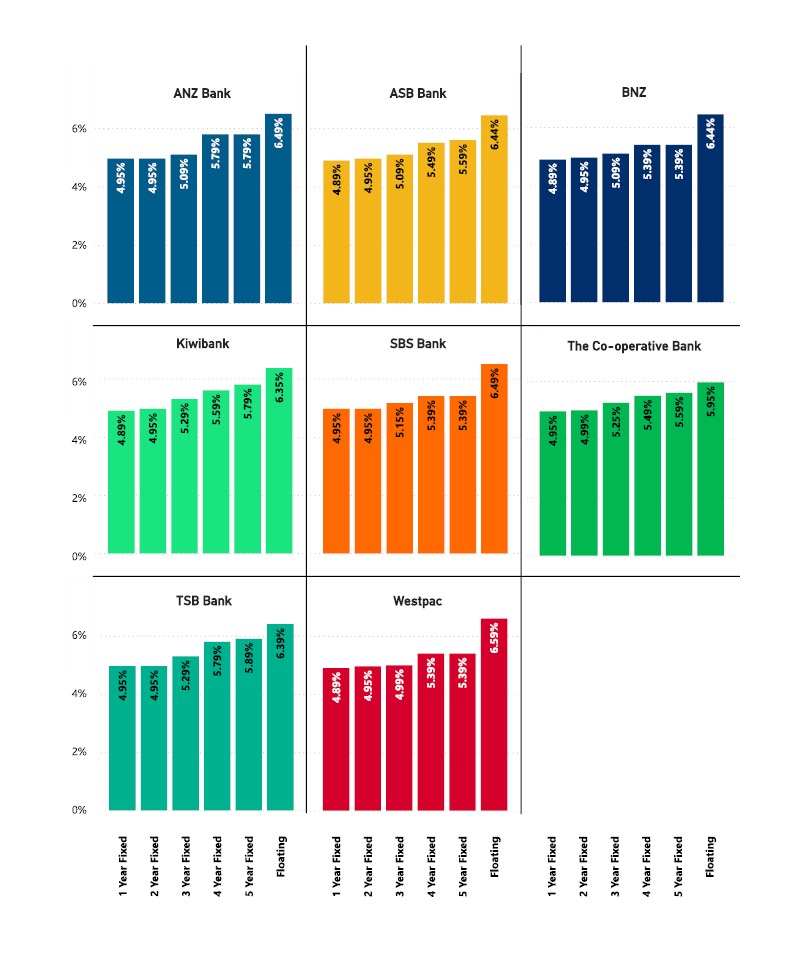

Latest Bank Mortgage Rates

Rate statistics, as at June 27, 2025

Latest Investment Mortgage Rates

Here is an overview of the current average, minimum and maximum rates for investor home loans on our database:

| Investment Mortgage Rates | |||||||

|---|---|---|---|---|---|---|---|

| Floating | 1-Year Fixed | 2-Year Fixed | 3-Year Fixed | 4-Year Fixed | 5-Year Fixed | ||

| Average | 6.69% | 5.13% | 5.11% | 5.33% | 5.69% | 5.79% | |

| Min | 6.59% | 4.89% | 4.95% | 5.09% | 5.39% | 5.59% | |

| Max | 6.89% | 5.49% | 5.55% | 5.59% | 5.99% | 5.99% | |

Rate statistics, as at June 27, 2025

Source: www.canstar.co.nz. Based on owner-occupier loans available for $500,000, at 80% LVR in Canstar’s database.

Lowest Mortgage Rates for Investors

If you’re currently considering a home loan, the table below displays some of the 1-year fixed-rate home loans on our database (some may have links to lenders’ websites) that are available for first investors. This table is sorted by current interest rates (lowest to highest), followed by company name (alphabetical). Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender about deposit requirements and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstar’s home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

Compare Lowest Home Loan Rates for Investors

About the author of this page

Bruce Pitchers is Canstar NZ’s Content Manager. An experienced finance reporter, he has three decades’ experience as a journalist and has worked for major media companies in Australia, the UK and NZ, including ACP, Are Media, Bauer Media Group, Fairfax, Pacific Magazines, News Corp and TVNZ. As a freelancer, he has worked for The Australian Financial Review, the NZ Financial Markets Authority and major banks and investment companies on both sides of the Tasman.

In his role at Canstar, he has been a regular commentator in the NZ media, including on the Driven, Stuff and One Roof websites, the NZ Herald, Radio NZ, and Newstalk ZB.

Away from Canstar, Bruce creates puzzles for magazines and newspapers, including Woman’s Day and New Idea. He is also the co-author of the murder-mystery book 5 Minute Murder.

Share this article