5… 4… 3… 2… 1… Blast-off! It’s not only billionaires lifting off. All indications are that interest rates are headed that way, too. Though hopefully not as fast or as high as Elon, Jeff and Richie.

Back in March 2020, the Royal Bank of New Zealand (RBNZ) cut the official cash rate (OCR) to the historic low of 0.25%. Faced with the pandemic, it also embarked on its Large Scale Asset Purchase (LSAP) program, to help keep interest rates low.

Now, over a year later, job done! The NZ economy isn’t doing too badly. The global economic recovery is in full swing, and things are looking up… including prices.

At its most recent meeting, in May, the RBNZ’s Monetary Policy Committee noted that: “A range of domestic and international factors are expected to lift headline inflation above 2% for a period.” But decided to keep its foot on the stimulus pedal.

Since then, however, the economy has continued to heat up, prompting the RBNZ to halt its LSAP program, at the end of June. And when it meets again, next week, most economists are betting that the RBNZ will start to raise the OCR.

Mortgage rate rises: coming soon

In a recent economic note, the ASB said it expects “the RBNZ to raise the OCR by 25bps in each of the next three OCR review dates (August, October and November), returning the OCR to pre-pandemic levels (1.0%) by the end of the year”.

And the ANZ goes even further, predicting that the RBNZ will start raising the OCR at its August meeting, with five more hikes taking the OCR to 1.75% by the end of 2022.

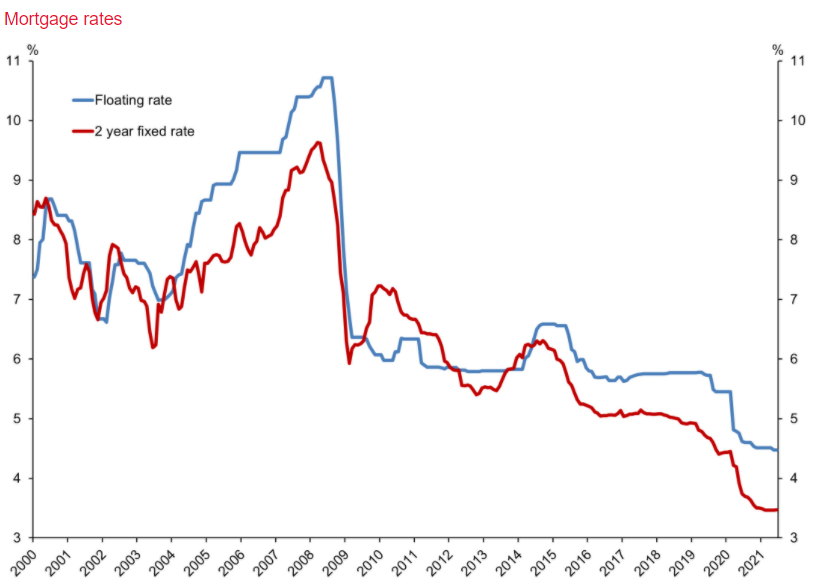

Given such predictions, banks have already started pricing the increased cost of borrowing into their products. Many have already raised their term-deposit, and long-term fixed mortgage rates.

So far, the increases have only been small. But even a return to pre-pandemic mortgage rates means a rise of about 1%. So how much is that going to cost you? Canstar crunched some numbers.

Mortgage rate rises: the costs

Before Covid hit, an average 2-year fixed-term rate for an owner occupier was around 3.5%. Here in the Canstar office, we should know. A couple of us fixed our mortgages for two years at the end of 2019, foreseeing that mortgage rates could not go any lower!

Now, on the Canstar database, the lowest one-year rate is 2.09%, and the lowest two-year rate is 2.49%. So, let’s make things easy, start at 2.5% and work out how much extra a 1% rate rise will cost an average mortgage holder.

And for an average mortgage holder, let’s look at the latest RBNZ stats on first home buyers. Back in June 2018, the average first home buyer took out a mortgage of $394,000. Fast forward to this year, the average mortgage of a FHB in June was $546,000, up a whopping 38%. But for simplicity’s sake, let’s round it off to a cool half a million.

Using Canstar’s Mortgage Repayment Calculator, this is how much extra each half a percent rate rise will cost on the fortnightly repayments of a 25-year, $500k mortgage.

| $500k Mortgage | 2.5% | 3% | 3.5% | 4% | 4.5% | 5% |

| Fortnightly Repayments | $1035 | $1094 | $1155 | $1217 | $1282 | $1348 |

As you’ll see from the bolded figures, if, as the ANZ predicts, the OCR increases by 1.5%, and we assume banks here increase their mortgage rates accordingly, the average punter will be paying an extra:

-

$182 per fortnight

-

$4732 per year

The last time the OCR sat at 1.75% was in March 2019 – a figure that it had been stuck at since November 2016. And during that entire period the average fixed 2-year rate hovered around 5%. Ouch! That’s an extra:

-

$313 per fortnight

-

$8138 per year

And for somebody who recently bought a $1 million home with a 20% deposit, their extra repayments will look like this as interest rates rise.

| $800k Mortgage | 2.5% | 3% | 3.5% | 4% | 4.5% | 5% |

| Fortnightly Repayments | $1656 | $1750 | $1848 | $1948 | $2051 | $2157 |

As yet, nobody knows how fast and by how much rates will rise. But it’s clear that the pandemic era of ultra-low interest rates is drawing to a close.

Paying off your mortgage faster

However, there’s no need to panic just yet. Mortgage rates are still low, and now’s a great time to take proactive steps to pay off your mortgage faster.

These include:

Paying off a little extra

Most lenders allow you to make extra payments of up to 5% of your current loan amount in each year of your fixed rate period, without being charged extra fees. Whether you choose to bump up your repayments or pay off lump sums, it’s a good idea to make extra repayments whenever your can.

Change your repayment frequency

Rather than making monthly repayments, choose to pay half your regular monthly repayment fortnightly, instead. Over the course of a year, you’ll make 26 repayments, which is equal to 13 monthly payments. That’s one extra month’s repayment per year!

→ Related article: Weekly or Monthly Mortgage Repayments: Which Pays Off Your Mortgage Faster?

Consider a home loan offset account…

…if you have a lump sum of cash sitting in your bank account. For example if you’re self-employed and set aside money for your taxes, consider offsetting the account against your mortgage. You’ll have to set part of your mortgage to a floating rate to access this facility, but it could save you money.

Check you’re paying a competitive rate

At the time of writing, there’s over a 1% difference between the highest and lowest fixed home loan comparison rates on Canstar’s NZ database. So if your home loan is at the expensive end of the spectrum, it would pay to compare rates and shop around for a better deal.

If you’re currently considering a home loan, the table below displays some of the 2-year fixed-rate home loans on our database (some may have links to lenders’ websites) that are available for first home buyers. This table is sorted by Star Rating (highest to lowest), followed by company name (alphabetical). Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstar’s home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

About the author of this page

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce began his career writing about pop culture, and spent a decade in sports journalism. More recently, he’s applied his editing and writing skills to the world of finance and property. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce began his career writing about pop culture, and spent a decade in sports journalism. More recently, he’s applied his editing and writing skills to the world of finance and property. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article