CRO is the native token of the fast growing Crypto.com platform. Crypto.com is a payment and cryptocurrency platform that allows users to buy, sell, and pay with crypto. Its offering covers a digital asset exchange, a point of sale VISA card, payment services, borrowing and lending solutions, and a smart contract platform blockchain.

What is CRO?

CRO coin is Crypto.com’s native token, and CRO holders receive perks when using Crypto.com’s products and services. They pay discounted trading fees when using the exchange, they earn more when they lend, and CRO-holding Crypto.com cardholders receive additional benefits, such as higher CRO cashback.

CRO is also the settlement asset on the Crypto.org chain, a blockchain running under the Crypto.com brand, in a similar vein to the Binance Smart Chain and Binance. CRO also supports Crypto.com’s recently released Ethereum Virtual Machine (EVM) compatible Cronos chain.

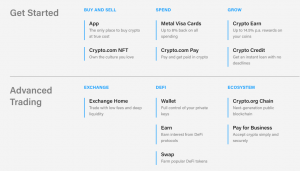

What’s available at Crypto.com:

Crypto.com’s history

Crypto.com was founded in Hong Kong in 2016 by its current CEO Kris Marszalek under the name Monaco. At the time it was more of a pure payment gateway VISA card-based solution and had the slogan “Spend anywhere, without fees”.

2017

In the first half of 2017, the company launched its own token, MCO, funded via an initial coin offering (ICO). The company managed to raise US$26.7 million through publicly selling 12,135,542 MCO tokens, about a third of the total supply.

2018

In July 2018 the company announced it would be re-branding to Crypto.com and began shipping its signature Visa debit cards. In the same year, the company announced the launch of the Crypto.com platform blockchain that would be supported by the soon-to-be-launched CRO token.

2019

In 2019 Crypto.com launched more services. This included crypto-to-crypto exchange services with the aiming of being a more broad one-stop shop for crypto users. In the same year, the company began offering centralised crypto borrowing and lending services.

2020

In 2020, the company launched its non-custodial DeFi wallet and new non-custodial swap capabilities and decided to phase out the MCO token completely and get users to swap it for the CRO token. This meant that all the previous MCO utility was transferred to CRO, and the Crypto.com Visa card became available across more regions globally.

In 2020, the company launched its non-custodial DeFi wallet and new non-custodial swap capabilities.

2021

In 2021, Crypto.com launched its Non-Fungible-Token (NFT) marketplace, which is designed to challenge the incumbent leader in the space, OpenSea. The NFT marketplace has a dedicated space on the Crypto.com website, and has been used by major brands including Snoop Dogg, Aston Martin and Serie A.

Crypto.com’s cards

Crypto.com offers a range of prepaid Visa Cards. The cards can be used in the same way as a debit card, anywhere Visa is accepted. However, as they are prepaid cards, they need to be topped up with funds first, before they can be used.

What makes Crypto.com’s Visa cards different is that in addition to using bank account transfers or other credit/debit cards to top up the card, you can also use cryptocurrency.

The cards have no annual fees, and come with a range of cashback rates and freebies, such as streaming services and airport lounge access, depending on how much money you keep in your Crypto.com app wallet.

While the cards are available in Australia, they are not yet being issued in New Zealand.

Crypto.com: What’s all the hype?

From a shaky start …

Crypto.com is a giant that is one of the most touted and used platforms in crypto. However, Crypto.com’s recent history hasn’t been entirely without missteps. One of the biggest suppressants of the CRO token price was the fallout of the MCO token swap and transition to a CRO token-only ecosystem.

Early supporters who had put their money into MCO felt cheated when Crypto.com set MCO-to-CRO exchange rates at a level that left many out of pocket.

The usability of Crypto.com products also raises questions. The platform continues to be unpredictable and is prone to crashing during periods of high traffic. Although, in fairness, this is a problem that affects many other exchanges, including Kraken and Coinbase.

… to infinity and beyond

However last year the tide began to turn. Over the past 12 months, Crypto.com has spent hundreds of millions of dollars on an international marketing blitz. In the process, it has employed the services of Matt Damon to spruik its services.

From a shaky start, Crypto.com has built itself into a one-stop shop for retail crypto users. It offers everything a crypto native or newcomer might need or want. Spot and derivatives trading, centralised and decentralised financing services, NFTs, point of sale solutions and staking rewards.

As a result, it’s seen its price soar. At time of writing, it was the 21st largest crypto by market cap, at NZ$13,27bn, and trading at 75c, up from around 10c a year ago.

It seems inevitable that Crypto.com will grow and gain more users. As long as Crypto.com can deal with its accessibility issues, the value of the CRO is likely to continue growing with it.

Learn more about cryptocurrency here

Subscribe to Brave New Coin

Boost your cryptocurrency and blockchain market intelligence. Brave New Coin’s suite of newsletters delivers curated crypto content for traders, analysts, investors and digital asset enthusiasts. From daily news and weekly wraps, to deep dive research and the latest market trends – click here to stay informed.

Boost your cryptocurrency and blockchain market intelligence. Brave New Coin’s suite of newsletters delivers curated crypto content for traders, analysts, investors and digital asset enthusiasts. From daily news and weekly wraps, to deep dive research and the latest market trends – click here to stay informed.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article