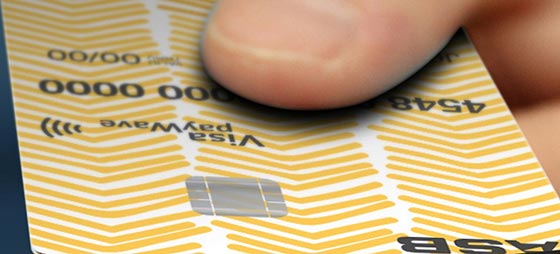

The low-rate card has the bank’s lowest ongoing purchase rate, 13.5% at the time of writing. ASB Visa Light also has a “Smart Rate” offer of 0% per annum, fixed for six months for big ticket items of $1000 or more.

ASB head of cards, Glen Martin, believes the bank’s latest credit card rivals other low-rate credit cards.

“Customers have told us they want a card with no account fee and a low interest rate on purchases. ASB Visa Light offers both – it’s the best of both worlds,” Mr Martin says in a press release.

He stresses that customers need to choose a credit card to suit their individual financial situation, and that rewards schemes aren’t right for everyone.

“Many rewards card customers don’t pay off the balances each month, so they are actually paying more in interest than the value of the rewards they are earning, which means it’s not actually the right card for them,” he says.

“ASB Visa Light is the card for everyday use if you don’t want rewards and are not paying off your credit card each month,” Mr Martin says.

Choosing the right credit card to suit your spending

Comparing credit cards and credit card rewards schemes helps to work out what is the best option, depending on how you spend. Ultimately the right card will vary depending on how much you spend – and your ability to pay it off.

ASB’s new credit card follows American Express launching a new high-earning flight rewards card, American Express Airpoints Platinum card.

The new Airpoints Platinum card from American Express gives members one Airpoint for every $59 spent, and the annual fee has also been slashed by $200 – from $395 to $195 per year.

Any information on this page is general and has not taken into account your objectives, financial situation or needs. Seek advice from a licensed financial adviser before making any investment decisions. See our detailed disclosure.

CANSTAR is an information provider and in giving you product information CANSTAR is not making any suggestion or recommendation about a particular product. If you decided to apply for a product, you will deal directly with a financial institution, and not with CANSTAR. All product information should be confirmed with the relevant financial institution. For more information, read our detailed disclosure, important notes and additional information.

Featured image: iShootPhotosLLC | iStock

Share this article