The world has been printing money for several years, in anticipation of inflation and interest rates eventually rising. Neither of those happened.

The main reason we didn’t see inflation was due to technology driven deflation. Higher wage costs simply encourage more automation and digitisation. Technology delivers scale and lower costs everywhere, eventually. It also creates greater price transparency, and with that comes more competition.

But recently the cost of building has jumped, with demand outstripping supply. We are also seeing wage inflation, for the first time in a long while, as businesses compete for skilled employees.

If companies weren’t clearing backlogs and if borders were open allowing new immigrants into jobs, would we have inflation? Probably not.

Low rates are here to stay

Prices are going up. But, ultimately, higher mortgage rates will bite, consumption will slow down, borders will open back up, which will free up labour, and technology will continue to push us towards low-cost scale and automation.

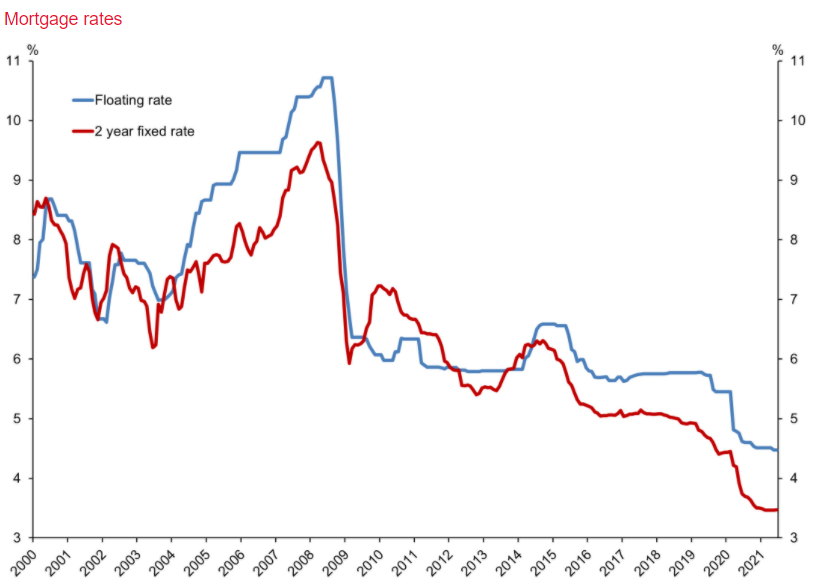

The Reserve Bank has pulled back on its money printing and is signalling a 1.5% increase in interest rates over the next couple of years. To me that feels about right. Mortgage rates will still be low, with a 1-year fixed rate sitting at around 3.50%, which is still extremely low by historic comparisons.

Low rates are here to stay with Kiwis owing more than $300 billion in mortgages. But it doesn’t take much of a rate increase before borrowers start to feel the pinch.

The starting point for rate increases is still the second half of next year, but banks are bringing forward their view to as early as November this year. Long-term mortgage rates have started to increase as more borrowers try and fix into longer-term rates. There is a real likelihood that long-term mortgage rates go higher than necessary.

→ Related article: Mortgage Rate Rises: How Much Will They Cost You?

Are long-term fixed rates attractive?

It depends on your view of how much rates need to increase. I don’t think long-term fixed rates over 3% look attractive if you can still fix for two years at 2.49%. To take a five-year fixed rate at 3.5%, the break-even would be fixing again in two years at about 4.5%. I just don’t see that.

For property investors, mortgage rates are coming off extremely low levels. Even with a relatively small increase of 1.5%, that is still a 60% increase in absolute servicing costs. That will be felt by investors, more so because tax deductibility is being progressively removed.

In theory, higher mortgages rates (and lower tax deductibility) will translate to investors looking for higher yields. With higher interest rates, and higher yield expectations, the prospect of increasing house prices is coming to an end.

John Bolton founded Squirrel in 2008. He is a former General Manager at ANZ, where he was responsible for the bank’s $60bn of retail lending and deposits. He has 10 years of senior banking experience behind him in financial markets, treasury, finance, and strategy, and is a director of Financial Advice New Zealand, the industry body for financial advisers.

John Bolton founded Squirrel in 2008. He is a former General Manager at ANZ, where he was responsible for the bank’s $60bn of retail lending and deposits. He has 10 years of senior banking experience behind him in financial markets, treasury, finance, and strategy, and is a director of Financial Advice New Zealand, the industry body for financial advisers.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article