Over the ditch in Australia, floating rates tend to be lower than fixed mortgage rates. Therefore they are the mortgage rates of choice for most homeowners. But here in NZ, it’s the other way around.

Currently only about 12% of residential home owners with a mortgage are on a floating rate. And for good reason. Historically, floating rates have always been higher than fixed.

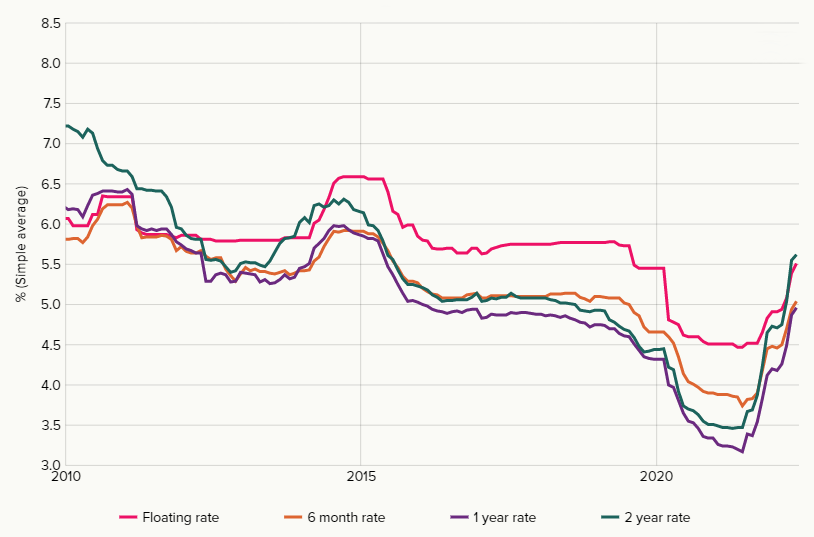

As you can see from the graph below, over the past ten years, floating rates have always been considerably higher than 1- and 2-year fixed terms.

New standard residential mortgage interest rates for selected terms less than three years including floating:

But now things are starting to change. Just a year ago, back in July 2021, the average floating rate on Canstar’s Database was nearly 2% higher than the one-year fixed rate:

| Owner-Occupier Mortgage Rates | |||||||

|---|---|---|---|---|---|---|---|

| Floating | 1-Year Fixed | 2-Year Fixed | 3-Year Fixed | 4-Year Fixed | 5-Year Fixed | ||

| Average | 4.33% | 2.55% | 2.86% | 3.22% | 3.58% | 3.87% | |

Rate statistics, as at July 23, 2021

Source: www.canstar.co.nz. Based on owner-occupier loans available for $500,000, at 80% LVR in Canstar’s database.

Latest Owner-Occupier Mortgage Rates

However, now nearly 12 months on, the average floating rate is better than most fixed-year rates. And the lowest rate on our whole database is 4.09%, for a floating rate. So if your mortgage is up for renewing, is it worth fixing, or should you float on a new low rate?

| Owner-Occupier Mortgage Rates | |||||||

|---|---|---|---|---|---|---|---|

| Floating | 1-Year Fixed | 2-Year Fixed | 3-Year Fixed | 4-Year Fixed | 5-Year Fixed | ||

| Average | 5.52% | 4.65% | 5.30% | 5.54% | 5.93% | 6.07% | |

| Min | 4.09% | 4.34% | 4.99% | 5.35% | 5.55% | 5.59% | |

| Max | 5.95% | 5.35% | 5.94% | 5.99% | 6.35% | 6.45% | |

Rate statistics, as at June 10, 2022

Source: www.canstar.co.nz. Based on owner-occupier loans available for $500,000, at 80% LVR in Canstar’s database.

Fixed or Floating Mortgage Rates?

Deciding to fix a mortgage always involves some difficult decision-making. Especially at the moment. As you can see from the above figures, rates have soared over the past year. And the Official Cash Rate (OCR) looks set increase even further over coming months.

In its latest Economic Note, the ASB writes: “… getting inflation under control is still the priority for the RBNZ for now, and we still see the OCR hitting 3.50% and mortgage rates moving a bit higher over the remainder of the year. 2023 is when the calculus will start to get a bit tougher, particularly if the housing market slowdown deepens more than we expect.”

So if you expect rates to continue to rise, should you lock in now? Or if you think that rates are near their peak and will start to soften from next year, do you plump for a lower floating rate and ride out the next few months until rates start to soften?

Fixed or Floating: A Tricky Decision

It’s a tricky decision. But, at its core, you need to remember that a floating rate home loan can fluctuate at any time. In general, floating rate home loans are far more responsive to changes in the OCR than fixed-rate loans.

Generally, when the OCR falls, you can expect the interest rate on your floating-rate home loan to fall soon afterwards; and when the OCR increases, you can expect an increase in the interest rate on your home loan almost immediately.

Fixed-rate home loans, on the other hand, theoretically, have already priced short-term predicted rises and falls in the OCR into their fixed interest rates, so should not be as quickly responsive to RBNZ cash rate decisions.

So you need to ask yourself what difference a fluctuating interest rate could make to your home loan and how that could affect your budget. To discover what a fluctuating rate could mean for your finances, experiment with our home loan repayments calculator.

Ultimately, you need to consider whether you want to take advantage of rate fluctuations by floating your mortgage, or whether you are better off opting for the certainty of monthly repayments.

Fixed Home Loan Rates: Pros & Cons

Possible benefits of a fixed-rate home loan

- Predictable repayments until the end of the fixed term

- Currently, one- and two-year fixed rates are still competitively priced compared to variable rates

- If the OCR rises, your repayments stay the same

Possible disadvantages of a fixed-rate home loan

- If rates fall during your fixed-rate period, you could find yourself paying higher than market rates

- Conversely, if rates increase during your loan period, you could find yourself facing higher rates once your fixed-term expires

- Break fees on fixed-rate home loans can be hefty during periods of falling rates

Floating Home Loan Rates: Pros & Cons

Possible benefits of a floating-rate home loan

- Sticking to a floating-rate home loan gives you the ability to capitalise on any downward rate movements

- If rates go down, so do your repayments, allowing you to pay more into your loan. This could save you money in the long term

- It’s flexible: if you want to refinance, move house or terminate your home loan contract for any reason, you can without break fees

Possible disadvantages of a floating-rate home loan

- If rates go up you face higher repayments. This might be a challenge if you are on a tight budget

- If the OCR increases rapidly, you may find that it’s too late to lock in a favourable fixed-rate home loan

Best Floating Home Loan Rates

Ultimately, choosing a home loan is about more than just interest rates. When Canstar compares and rates mortgages and mortgage lenders, our expert researchers look at each home loan and awards points for the array of features it offers and its comparative price, which includes rates and fees.

The best products then receive our 5-Star Ratings for Outstanding Value. We place a lot of importance on our ratings, which is why the comparison grids below are sorted first by Star Rating, highest to lowest. However, if you want to compare by lowest rates instead, just click through to access our full mortgage rate comparison tables.

The table below displays some of the floating home loans on our database (some may have links to lenders’ websites) that are available for home owners looking to refinance. This table is sorted by Star Rating (highest to lowest), followed by company name (alphabetical). Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstar’s home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

Compare home loan rates for free with Canstar!

About the author of this page

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce began his career writing about pop culture, and spent a decade in sports journalism. More recently, he’s applied his editing and writing skills to the world of finance and property. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce began his career writing about pop culture, and spent a decade in sports journalism. More recently, he’s applied his editing and writing skills to the world of finance and property. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

Enjoy reading this article?

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article