Author: Josh Gilbert

Why does the stock market go down?

When the stock market crashes it can often be difficult to define exactly what caused the downturn. It’s rarely ever black and white. However, there are some key factors that will often have a part to play when there is a dip in the market.

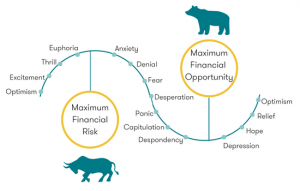

Market sentiment is one such factor that can dictate whether markets go up or down. Broadly speaking, market sentiment is typically characterised as either being bullish (positive and optimistic) or bearish (negative and pessimistic). Market sentiment has historically been observed to be a highly cyclical phenomenon that has been driven fundamentally by human emotion. Cycles in market sentiment have led to significant fluctuations in asset prices including across property and shares.

The economic climate, war and even natural disasters have also been known to drive the stock market into a downward trend.

What to do when the stock market goes down?

For those new to investing, here are a few things to keep in mind to maintain a level head and make responsible investment decisions.

1. Don’t panic

While the stock and crypto markets can often invoke a lot of passion, it’s important that rookie investors keep their emotions at bay and take a calculated approach when investing. All markets can be volatile. So it’s best to remain calm, regardless of whether the market is experiencing a bull (when the market goes up) or bear run (when the market goes down).

2. Adopt a long term investment strategy

Rather than quickly selling stocks or cryptoassets at a whim in order to “get rich quick” when a market is falling, try adopting a long-term investment strategy instead. If you chop and change your investments frequently, you could miss out on potential important profits that may emerge when the markets start to rise again.

3. Understand your risk tolerance

For inexperienced investors, a rapid decline in their portfolio can be unsettling, to say the least. This is why it’s crucial to understand their risk tolerance when they are in the process of setting up their portfolio and not when the market is in the midst of a sell-off.

Your risk tolerance depends on a number of factors, such as your investment time horizon, what you can realistically afford, and emotional response.

Losses are an inevitable part of investing, but this doesn’t mean you can’t try to prepare for and limit them where possible. Ultimately, you should be ready for the worst and have a solid strategy in place to protect yourself.

You can also choose to use risk management tools such as stop losses to help protect your investments and set your risk tolerance.

5. Diversify, diversify, diversify

One way to hedge against your losses is to diversify your portfolio. Investing exclusively in tech stocks or Bitcoin may cause you to lose a significant amount of money if that particular sector or asset goes down.

This is why many investors strategically make other investments in a variety of sectors, industries, and different asset classes (from stocks, crypto, commodities, real estate etc) to spread out their exposure and reduce their risk.

6. Remember bear markets are normal

Market fluctuations are normal, both in an everyday investor (also known as a retail investor) or even a professional’s (institutional) investment journey. Whether it’s down for a matter of days, weeks or even months – history demonstrates that markets tend to recover from market corrections and go back up. Markets are influenced by a variety of external and internal factors such as political tensions, a change in government, or even during a global pandemic.

7. Consider buying in the dip

Market drops aren’t always a negative thing, in some cases, you might be able to nab yourself a great stock at an affordable price.

When the stock goes down, prices tend to get cheaper and cheaper. While some investors don’t want to buy a stock that’s falling in value, others may see its true future value and opt to buy in the dip with the goal of holding onto it until it starts to perform well again.

8. Be careful of timing the market

When attempting to time the market, an investor tries to predict the future market price of a stock. Meanwhile, when an investor invests to grow their wealth in the long term, they buy stocks without trying to guess when the market will be at its lowest and highest point.

Timing the market can cause a lot of stress for an investor, so do your research and really understand the stock and the market before making a decision.

Where to buy Crypto in NZ

The display order does not reflect any ranking or rating by Canstar. The table does not include all providers in the market.

| Provider | Fiat Currencies | Bitcoin | Other Currencies | Est. |

| Easy Crypto | NZD, AUD | Yes | 100+ | 2018 |

| Independent Reserve | NZD, AUD, USA | Yes | 24 | 2013 |

| Kiwi Coin | NZD | Yes | No | 2014 |

| Swyftx | NZD, AUD | Yes | 228 | 2017 |

This information is not an endorsement by Canstar of cryptocurrency or any specific provider. Canstar is providing factual information supplied by providers. Cryptocurrencies are speculative, complex and involve significant risks. Canstar is not providing a recommendation for your individual circumstances or in relation to any particular product or provider.

9. Average into the market with dollar-cost averaging

If you’re a long-term investor, one option is to average into the market by dollar-cost averaging. This means you purchase regardless of the price, and you end up buying when the price is low and when the price is high. Over the long run, your cost will be the average of the highs and the lows.

10. Remember your reason for investing in the first place

Finally, it’s a good idea to take a step back and remember your motivations for investing. If it’s to build your nest egg so you can have a comfortable retirement, for example, you ideally don’t need the funds right now.

Take a big deep breath and ask yourself: “Do I have confidence in my investments?” If the answer is yes, then step back and enjoy the experience.

Compare Online Share Trading Platforms

About the reviewer of this page

This report was reviewed by Canstar Content Producer, Andrew Broadley. Andrew is an experienced writer with a wide range of industry experience. Starting out, he cut his teeth working as a writer for print and online magazines, and he has worked in both journalism and editorial roles. His content has covered lifestyle and culture, marketing and, more recently, finance for Canstar.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article