Author: Nicola Field

Buying a home may once have been the great New Zealand dream. And even though it’s still a goal plenty of us aspire to, declining affordability is seeing patterns of home ownership change.

One of the reasons home ownership is so much a part of our national psyche is because our homes grow in value over time. In the past five years alone, the average national house price is up almost $300,000 (October 2017-22).

But the upside of owning the roof over your head goes beyond rising property prices.

The pros of owning a home

There are plenty of pros to owning a home. For starters, as mentioned above, over time property prices rise. That can provide a nice nest egg for later in life.

Furthermore, paying off a home loan is a form of forced saving. If you don’t pay your mortgage, the bank can sell the place from under you. For most of us, that’s a compelling incentive to stay on top of loan repayments. And it stands us in good stead later in life, as homeowners are generally well-placed to enjoy a comfortable retirement.

This assumes our homes are fully paid off by the time we exit the workforce.

Tenants, on the other hand, continue to face the cost of rent after they’ve hung up their work boots. This sees renters more likely to experience financial stress in retirement.

The pros of renting

Renting may not be the first choice for many, but it does have upsides. As a tenant, you have the freedom to live wherever you choose. You may not be able to afford to own an inner-city terrace, but chances are you could afford to rent one. If it turns out you’re not a fan of inner-city living – or your job takes you to new destinations – you can generally pull up stumps and move without lengthy delays or significant costs.

Another of the underrated joys of renting is the lack of repair and maintenance bills. If the hot water cylinder breaks, it’s the landlord’s problem, not yours.

The costs of owning a home

The key downside to home ownership is the cost. Buying a home brings a raft of upfront expenses, notably the sizeable deposit that’s required.

That’s followed by what may be several decades of paying home loan interest, plus all the outgoings associated with owning property – from rates and insurance through to repairs and maintenance.

Tenants can have higher disposable incomes than homeowners

Home ownership can be great, but it doesn’t come cheap. This explains why, in some scenarios, tenants can have a higher disposable income than homeowners – disposable income that can go towards building personal wealth.

And with mortgage rates currently rising, homeowners are feeling the pinch even more.

5 ways to build wealth without owning a house

So the question is, where should you invest so that renting doesn’t leave you behind financially? Here are five options:

1. Invest in a rental property

Maybe you can’t afford a home to live in. But if you want to keep a hand in the property market, it may be possible to buy as an investor. This offers far more freedom in your choice of locations. You don’t need to make buying decisions based on personal needs, which frees up options like buying in more affordable regional markets.

Along with rental income to assist with loan repayments, you can benefit from any increases in the property’s value over time.

Do note, however, that many benefits on offer for first home buyers, such as KiwiSaver withdrawals, are not available if buying as an investor.

→Related article: Rentvesting: How it Works and the Pros and Cons

2. Grow your KiwiSaver

Speaking of KiwiSaver, it’s a great way to invest in your future. Investing in KiwiSaver has the benefit of earning free employer and government contributions, and locking away your funds until retirement, providing the potential for some serious long-term gains.

Although, it’s crucial you’re in the right KiwiSaver fund for your needs.

KiwiSaver members also get some great extra benefits for when it does come time to buy their first home.

→Related article: Can I Use KiwiSaver to Buy Land or a First Home?

3. Build a share portfolio

Shares have plenty going for them as an investment. You need very little capital to get started and you can sell your shares at a moment’s notice if you need funds in a hurry.

There’s also the possibility to make strong gains. Just imagine how different things could be had you invested in Apple even just 10 short years ago.

Of course, for every Apple, there are plenty of other stocks that have fared poorly. So make sure you understand the risks.

→Related article: Investing for Beginners: Tips for Starting a Share Portfolio

4. Consider exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) offer an easy way to grow a highly diversified portfolio even if you don’t have plenty of time – or capital – to invest.

ETFs allow you to invest in a basket of shares in a single investment. So instead of investing in 50 different NZ companies, you invest in a single ETF (The NZX50 ETF) which includes shares of the top 50 NZ companies.

Options span everything from New Zealand shares, international shares, market sectors, and even commodities such as precious metals or crude oil.

It’s worth noting that most, though not all, ETFs are index funds. This means they take a passive approach, aiming to match the market they invest in, rather than trying to beat it.

However, this still offers plenty of opportunities for growth. For example, the NZX50 is up almost 500% since 2003 (as of November 2022).

Do note that ETFs may charge fees.

→Related article: Exchange Traded Funds: What is an ETF?

5. Invest in… you

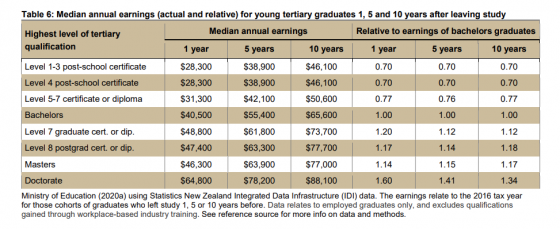

If you’re looking for an outstanding investment, the answer could be right there in the mirror. By upskilling, you may open up new career opportunities that can grow your income (as highlighted below).

This could involve going back to university to obtain a degree, or it could be as simple as doing an online course to expand your existing skillset and open up new avenues within your sector.

Although you do also need to weigh up the fact that investing in you may require you to use your savings/take out a loan to cover the costs of further education.

Spread your money around

As they have the potential to earn more disposable income than homeowners, renters can take their pick of investments.

While we’ve offered five different options, it’s worth stressing these are not mutually exclusive. Mixing and matching is a smart idea as it lets you diversify your investments, which is a proven way to reduce risk.

The main point for renters is that investing on a regular basis calls for discipline. If that’s not your strong point, think about strategies to make it happen automatically. Like setting up regular purchases of ETF units, or investing in KiwiSaver where your funds will be locked away from reach. Though in that case, be sure you don’t overcommit.

Compare online share trading platforms

About the reviewer of this page

This report was reviewed by Canstar Content Producer, Andrew Broadley. Andrew is an experienced writer with a wide range of industry experience. Starting out, he cut his teeth working as a writer for print and online magazines, and he has worked in both journalism and editorial roles. His content has covered lifestyle and culture, marketing and, more recently, finance for Canstar.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article