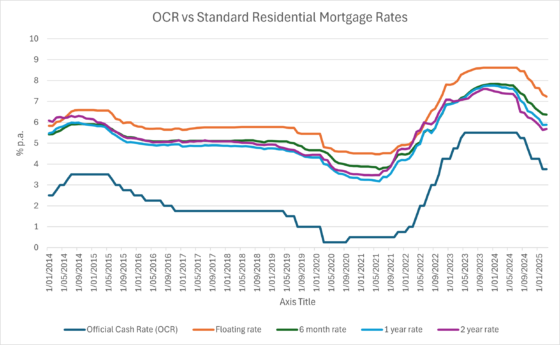

Between November 2021 and May 2023, the Reserve Bank (RBNZ) lifted the Official Cash Rate (OCR) from its all-time low of 0.25% to 5.50% – a level not seen since before the GFC, in 2008.

As a result, these increases in the cost of borrowing flowed through to mortgage rates. In August 2021, the average one-year fixed rate for owner-occupiers on Canstar’s mortgage database was 2.58%. And by January 2024, it was 7.5%.

But, thankfully, peak mortgage pain has passed. Since August 2024, the RBNZ has cut the OCR nine times, to 2.25%, and banks have reduced their mortgage rates. But whereto from here?

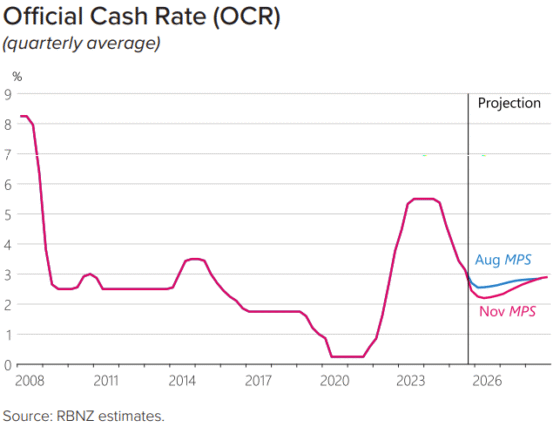

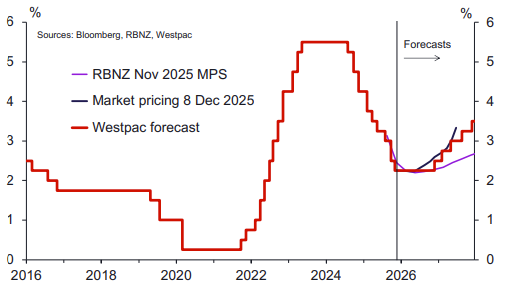

At its most recent meeting, in November, the RBNZ’s Monetary Policy Committee made what many economists think will be the final cut to the OCR of the current cycle. And, as you can see from the RBNZ’s revised OCR projection, it thinks the OCR could start creeping back up from the middle of 2026.

However, while variable mortgage rates dropped on the back of the OCR’s trim, the RBNZ’s revised OCR projection caused swap rates to rise, increasing the borrowing costs for banks, some of which have subsequently increased their longer term mortgage rates.

So given that indicators point to mortgage rates and the OCR having bottomed out, what are the major banks predicting over the coming months? Let’s take a look.

Below are synopses of the banks’ outlooks. Click on each bank’s name to jump to a more detailed overview of its predictions. And click here to see where, historically, mortgage rates have sat in relation to the OCR.

- ANZ: Thinks the OCR will remain at 2.25% throughout 2026, but that all fixed mortgage rates will rise to around 5% over the next 12 months.

- ASB: Says the RBNZ has finished with its OCR cuts, interest rates are as low as they will go, and markets are already predicting OCR hikes, which is pushing up lending costs for banks. This could lead to mortgage rate increases sooner rather than later.

- BNZ: The OCR has reached its terminal point, and it will remain there throughout 2026. However, mortgage rates will start moving upwards from mid-2026, so borrowers should start planning their borrowing strategies and looking to longer-term rates, which are currently good value.

- Kiwibank: Says that the RBNZ’s OCR tracker is a clear indication that we’ve reached the end of the current rate cycle, and that markets have already started to price in rate rises from the middle of next year.

- Westpac: The OCR will remain at 2.25% until mid-2027, when the RBNZ will start hiking it, and it will reach 3% by the end of 2028. However, due to higher retail rates, longer fixed-rate terms are already on the rise.

Lowest Mortgage Rates for Refinancing

Looking to refinance your mortgage? The table below displays some of the one-year fixed-rate home loans on our database (some may have links to lenders’ websites) that are available for home owners looking to refinance. This table is sorted by current interest rates (lowest to highest), followed by company name (alphabetical). Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstar’s home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

Compare Lowest Home Loan Rates for Refinancing

ANZ

ANZ believes the RBNZ will keep the OCR on hold throughout 2026. However it says that because the RBNZ has messaged that further cuts are unlikely, markets are already pricing in rate rises. As a result, ANZ has increased its longer fixed-term mortgage rates, as well as its term deposit rates.

As you can see from its forecast, below, ANZ has home-loan rates sitting around 5% by Q1 of 2026:

| Rate | March 2026 | June 2026 | September 2026 | December 2026 | March 2026 | June 2027 |

| Floating | 6.0% | 6.0% | 6.0% | 6.0% | 6.2% | 6.7% |

| 1-Year | 4.5% | 4.7% | 4.9% | 5.1% | 5.2% | 5.2% |

| 2-Years | 4.6% | 4.8% | 4.9% | 5.0% | 5.1% | 5.1% |

| 3-Years | 4.8% | 4.9% | 5.1% | 5.1% | 5.2% | 5.2% |

| 5-Years | 5.2% | 5.3% | 5.4% | 5.5% | 5.6% | 5.6% |

So when it comes to fixing, ANZ says it’s worth considering longer terms – especially since there’s very little separating 1- and 3-year rates at the moment – and that there’s merit in spreading your mortgage over different terms.

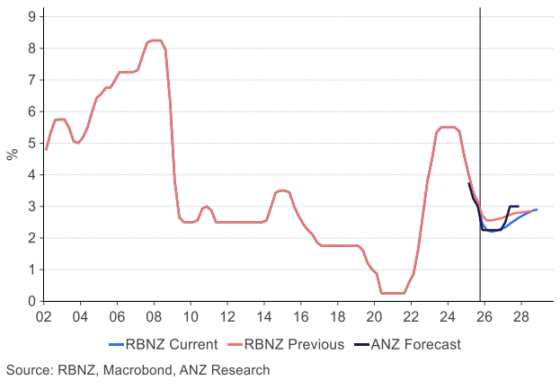

ANZ’s OCR & Markets Forecast December 2025

ASB

ASB thinks that there will be no further cuts to the OCR this cycle. However, it notes that borrowers shouldn’t expect mortgage rates to follow the OCR’s recent downwards trajectory.

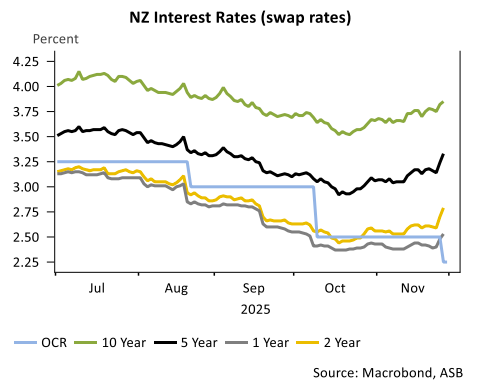

The bank’s chief economist notes that swap rates, which are the key market rates that influence what Kiwis pay for their mortgages, all jumped on the back of the OCR announcement.

This has put a lot of upward pressure on banks’ lending costs and, in turn, mortgage rates, which the bank believes are “as low as they will go”. So, jumping on a rate now, and fixing for longer, could be a good option.

Searching for the Cheapest Personal Loan?

If you’re looking for the cheapest personal loan, Canstar’s personal loan comparison tables can help. The table below displays the sponsored unsecured personal loan products available on Canstar’s database for a three-year loan of $10,000 in Auckland, with links to lenders’ websites. Use Canstar’s personal loan comparison selector to view a wider range of products on Canstar’s database. Canstar may earn a fee for referrals.

BNZ

BNZ says the current OCR is its terminal rate, and that it will be “on hold through 2026, with a first hike in early 2027”.

BNZ’s economists believe that the mortgage rate downtrend is almost over. But while home loan rates will start to increase from the second half of 2026, it expects many fixed rates to remain sub-5% for a significant portion of the year.

As a result, while there’s no rush to secure a low rate, ASB thinks there’s now merit in making a plan and looking to longer mortgage terms.

Its advice to borrowers: “For many, spreading risk over a range of borrowing terms (say one, two, and three-year) might be a prudent way of covering off the various risks in play.”

Kiwibank

Kiwibank’s economists have long called for cuts to the OCR. So they’re happy the RBNZ has finally moved, and reduced the OCR to a point where monetary policy is stimulatory.

While there’s a slight possibility that the RBNZ could cut again, Kiwibank’s economists think we’ve hit the low of the current interest rate cycle saying: “The hurdle for an additional cut is high.”

Kiwibank points to the fact that the RBNZ’s revised OCR tracker has a terminal rate of 2.20%, only fractionally lower than its current 2.25% level. And if the RBNZ was serious about a further OCR cut, its tracker would show a low of 2.10% to 2.15%.

However, Kiwibank’s economists warn that on the back of November’s OCR cut, wholesale rates lifted, as the market moved from expectations of further OCR cuts to pricing in the risk of rate rises from the middle of next year.

This means that further mortgage rate cuts, especially on longer term rates, are unlikely.

Westpac

Westpac says the OCR has reached the end of the easing cycle. From here, the OCR will stay at its current level until mid-2027, when the RBNZ will start hiking it towards 3%, by the end of 2028.

However, the bank notes that markets have responded to the RBNZ’s message that further OCR cuts are unlikely by pricing in a hike in the OCR to 2.50% by the end of 2026, which is putting pressure on mortgage rates.

Westpac’s economists comment that the margin between retail rates and wholesale rates is “as narrow as we have seen since the start of 2024”.

To this end, Westpac was the first of the banks to increase its longer term rates, of two years and over, and is advising borrowers that fixing for periods of two to three years is attractive.

Westpac Rates Forecasts 2025

Mortgage Rates vs OCR

Looking at current predictions, over the next 24 months the OCR could rise to around 3%. So on such a forecast, where can we expect interest rates to sit?

The last time the OCR sat around 3%, was 10 years ago, and then the banks’ carded shorter-term rates were just over 5%, which is exactly where they’re sitting now. And as you can see below, even though the OCR did subsequently drop to below 2% in the years leading up to the pandemic, mortgage rates remained pretty static.

So as the banks’ economists point out, you shouldn’t expect a lot more downward movement in current rates.

Although it’s worth pointing out that a bank’s advertised carded rate is different from its special rate. This means, if you’ve a 20%-plus deposit and a good credit history, you’re very likely to qualify for a better deal.

Compare Home Loan Rates with Canstar

About the author of this page

In his role at Canstar, he has been a regular commentator in the NZ media, including on the Driven, Stuff and One Roof websites, the NZ Herald, Radio NZ, and Newstalk ZB.

Away from Canstar, Bruce creates puzzles for magazines and newspapers, including Woman’s Day and New Idea. He is also the co-author of the murder-mystery book 5 Minute Murder.

Share this article