Unless you’ve been living under a rock for the last several years, or perhaps, just living abroad, you will have heard all about capital gains tax (CGT). It’s a contentious topic that has divided the nation and caused headaches for politicians.

While New Zealand doesn’t have a capital gains tax per se, you can be taxed on certain assets, if they increase in price. The property bright-line test is an example of this. All of which can make a big difference to your tax obligations. So what tax laws should you be aware of? Canstar takes a look.

What is a capital gains tax?

When you buy an asset and hold onto it, that asset may increase in value. This increase in value is called capital gains. If you live in a country that has a capital gains tax, the capital gains you make on certain asset might be taxed. Taxable assets vary, and can include shares, cryptoassets, and even artwork or jewellery. But a CGT is most commonly talked about in the context of property.

For example, if you bought an investment property for $500,000 and then sold it for $800,000, you would make a profit of $300,000. Under a capital gains tax on investment property, this $300,000 profit would be taxed. Not the entire $800,000, only the $300,000 profit, or capital gains.

Does New Zealand have a capital gains tax?

No. New Zealand does not have a capital gains tax.

But, it’s not quite that simple.

While we don’t have a capital gains tax in writing, we do have some laws that look, sound and act suspiciously like a capital gains tax. The most contentious of these incognito capital gains tax laws is the bright-line test property rule.

What is the bright-line test?

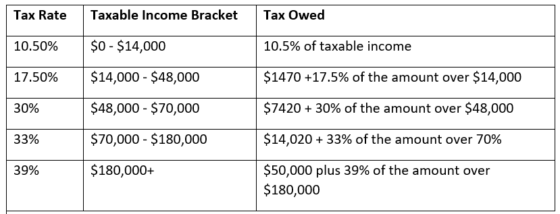

The bright-line test means that if you sell your property within a certain time period, the capital gains made (the profit) will be taxed. There is not a fixed rate of tax on this profit (like a regular CGT) rather, the profit is added onto your yearly income, and will be taxed at the appropriate income tax bracket.

Income tax rates in New Zealand

*These tax rates apply to your total income, from all sources. Not just income from capital gains.

Capital gains, particularly on property, tend to be substantial. For example, the previously mentioned $300,000 profit would see almost half of that amount taxed at a rate of 39%.

But because this profit is added onto your income tax, as opposed to being subject to a separate tax, it pushes even more of the profit earned over this top tax bracket. For example, if you earned a salary of $180,000 per year, then all capital gains earned would be over the top tax bracket, effectively taxing all your capital gains at 39%.

Some may argue that the bright-line test not only introduces a capital gains tax (under the guise of another name) but one at an unusually high rate. In the United States, for example, the CGT is set at a max of 20%, while many countries only tax a certain percentage of the actual capital gains, as opposed to the full amount. Across the ditch in Australia, they only tax 50% of the capital gains earned.

On the other hand, people argue the 10-year limit on the bright-line test means investors can simply hold onto the property long term, before selling tax-free. They also point to the fact that unlike many other nations, New Zealand has no stamp duties, land taxes, or inheritance tax, creating a favourable tax environment for property.

So the bright-line test is a capital gains tax?

Technically, no.

But it does share a lot of similarities. The main similarity being it is a tax on capital gains.

But, unlike a capital gains tax, the bright-line test only applies to property. So your Bitcoin is safe (well… we’ll get to that later).

Additionally, as mentioned above, the bright-line test currently applies to property bought and sold within a certain time period (currently ten years). That means, in order to avoid paying the tax, you could simply hold onto the property for ten years before selling it. This differs from a regular capital gains tax, which applies regardless of how long you own an asset.

Furthermore, if the property is your main home where you live, or you inherited the property, it is exempt from the bright-line test. The length of the bright-line test also depends on when you purchased your property.

The bright-line property rule looks at whether the property was acquired:

- On or after March 27, 2021, and sold within the 10-year bright-line period (5 years for new builds)

- Between March 29, 2018 and March 26, 2021, and sold within the five-year bright-line period

- between October 1, 2015 and March 28, 2018, and sold within the two-year bright-line period

Properties purchased prior to October 1, 2015 are not subject to the bright-line test.

If you are considering buying a home, it pays to keep on top of the current interest rates in the market. If you’re interested in comparing rates, just click on the button below.

Compare home loan rates for free with Canstar!

So if I sell my property, after 10 years, I won’t be taxed?

Maybe.

At this stage, if you hold the property for more than 10 years, before selling, you’ll not be subject to the bright-line test. But, the bright-line test is not the only form of property tax in New Zealand.

The Intention Rule

If you buy a property with the intention to sell it, you may be subject to tax. This rule can be a little confusing, as intention can be hard to clarify.

For example, if you buy a house with the intention of it being a long-term rental, but are forced to sell due to financial hardship, this would not be subject to the intention rule. Despite being a rental property, your intention when buying the property was to hold onto it, not to sell.

On the other hand, if you buy a family home, with the intention to sell it once the price goes up, this could be subject to the rule. In this case, your buying and selling history would likely play a role in whether or not you would be taxed.

Buying and selling history

Even if you only have one home at a time (the home you live in) you could be treated as a speculator or investor by IRD.

If you have a history of buying and selling property, you could find yourself subject to the intention rule listed above. For example, if you buy a family home, then sell and upgrade after a couple of years, before selling and upgrading again a couple of years later, IRD may view this as property investing.

In this case, you could find the profit on your sale taxed.

You have an association with a dealer or developer.

If you are in the business of property investing, you have to pay tax on your profit. But, if you’re in the business you would already know that.

However, if you are not in the dealer and developer industry, but have an association with it, you could also be subject to the rules. This means if you have a partner with a history of buying and selling, and you then buy your own first home, you could face the same rules as if you were buying for the purpose of making a profit.

This could also apply if you were, say, a shareholder of a development company.

How do I know if I need to pay tax on my property?

While the rules outlined above give an overview of the property laws in New Zealand, as you can see, it’s not always clear cut. Many of the laws have exemptions, and are applied on a case-by-case basis. Your best option is always to speak with a tax specialist, so you know what your tax obligations will be should you sell your property.

Does New Zealand tax other assets, such as shares and cryptocurrency?

Because New Zealand does not have a capital gains tax, how does it tax other assets that would commonly fall under a CGT?

Crypto

If you are buying and selling crypto with the purpose of making a profit, any money you make will be subject to tax. Additionally, if you earn interest through practices such as staking, this is also subject to tax. However, any losses you make could be liable for use as a tax deduction.

When you fill out your income tax return, you need to declare any profits made from crypto assets in NZD, regardless of whether you’ve cashed out your crypto into a fiat currency. These will be added to your income and taxed at the appropriate rate.

If you’re in doubt about your cryptocurrency tax obligations, it’s prudent to seek the advice of a tax expert in the field.

Shares

Shares may be subject to income tax if you are in the business of dealing in shares. The IRD rules around this are complex so, if in doubt, consult a tax specialist. But, if you’re just dabbling in shares through an app, such as Sharesies, any dividends you earn will be subject to tax. But your app should take care of this on your behalf, based on the details you supply them with.

Click here for Canstar's online share trading award!

TradeMe (or other online sales)

Casual selling on TradeMe doesn’t need to be declared, but if you regularly sell it could be seen as a business, which will be subject to tax.

Artwork, jewellery and everything else.

Unlike property, where New Zealand’s tax laws look suspiciously similar to a capital gains tax, In this area, New Zealand makes it clear: NZ does not have a capital gains tax.

Under a CGT, all capital gains are taxable. This isn’t only on property or the sale of shares, but on things like artwork, jewellery, a car or even a boat that has increased in value over time. If it’s earned capital gains, it can be taxed.

In New Zealand, however, these are not taxed. So, if you bought a painting from an unknown painter, who years later is a household name, you can expect to sell your painting for a tidy, tax-free profit.

Again, this applies to a one-off or infrequent sale. If you are trading art or jewellery regularly, it could be seen as a business and be subject to tax.

About the author of this page

This report was written by Canstar Content Producer, Caitlin Bingham. Caitlin is an experienced writer whose passion for creativity led her to study communication and journalism. She began her career freelancing as a content writer, before joining the Canstar team.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article