What is Solana?

Created in 2017 by Anatoly Yakovenko alongside current Solana board member and Chief Operations Officer Raj Gokal, Solana is an open-source blockchain that supports smart contracts, including non-fungible tokens (NFTs) and a variety of decentralised applications (dApps).

As a result, it’s often seen as a rival to Ethereum.

The main goal of Solana is to scale throughput while keeping transaction costs low. Currently, crypto transaction speeds pale in comparison to Mastercard and Visa (about 16 transactions per second compared to up to 65,000), limiting their practicality as a payment system. And the NFT and DeFi boom on platforms such as Ethereum has caused transaction costs to soar.

But these are both issues Solana seeks to address. Offering quick transactions, for cheap.

How does Solana address these issues?

Solana runs on a hybrid consensus protocol of proof-of-stake (PoS) and a concept Solana calls proof-of-history (PoH). This differs from both the Proof of Work consensus used by Bitcoin and the current Proof of Stake consensus used by blockchains such as Cardano.

What is Proof of Work and Proof of Stake?

Proof of work is the original blockchain model. With proof of work, miners need to solve cryptographic puzzles in order to be able to add the next block to the blockchain. Whoever solves this puzzle first, wins the right to add the next block to the blockchain. They are then rewarded new coins for doing this work.

This is intensive, as everyone is running the same race in an effort to be first.

With Proof of Stake, there are validators. These validators look at transactions, make sure they are correct and then put them into a new block. To be a validator you have to put in a stake (some cryptocurrency) to be given the opportunity to validate a block. It’s like an insurance to say you’ll do a good job (not validate fraudulent transactions) because the blockchain is holding your stake ransom.

The higher your stake the more chance you have to be selected. Whomever is selected to validate the block, does so, and is rewarded with the fees paid by the transactions that were in that block.

Proof of Stake is less intensive than PoW. Everyone lines up to race, but only one person is actually selected to run.

What is Proof of History?

Blocks on the Bitcoin blockchain are large and unorganised. Each BTC miner adds the time and date to the block they mine based on their local time. Other nodes in the network then have to verify that the timestamp provided by the miner is valid, because it may be false or differ from the time reported by other miners. This is time-consuming.

Solana uses the same hashing function as Bitcoin, SHA-256. But it uses a unique, trustless way to determine the time of a transaction called Proof-of-History (PoH).

The SHA-256 algorithm takes inputs from users and encrypts them to produce a unique output that is difficult to predict. Solana takes the output of a transaction and uses it as the input for the next hash. The order of the transactions is now inbuilt into the incoming hashed output. This is different from how the Bitcoin blockchain operates.

The Solana PoH hashing process creates a long, unbroken chain of hashed transactions. This is designed to create a clear and verifiable order of transactions so that when a validator adds to a block, they don’t need to use a conventional timestamp.

→Related article: What is Bitcoin? A Beginner’s Guide to Bitcoin

How does this improve throughput?

By ordering transactions into a chain of hashes, Solana validators are able to process and transmit less information per block. Having that hashed version of the latest state of transactions constantly recorded greatly reduces the time to confirm each block on the Solana chain. Transactions on Solana are verifiably ordered without all nodes needing to agree simultaneously. This is a key reason why it is so quick.

Proof-of-History combines with other features of Solana to optimise and speed up throughput. For example, TowerBFT uses the cryptographic clock enabled by PoH to speed up blockchain consensus by reducing messaging overhead and transaction latency. Selecting the next Proof-of-Stake node to validate a block of transactions becomes faster because nodes need less time to verify the order of transactions.

Learn more about cryptocurrency

Why does Solana have such low fees?

On platforms such as Ethereum, fees are based on demand. If a lot of people are trying to process transactions, fees can soar. Especially as the number of transactions possible per second, is extremely limited, and demand has been extremely high.

But because Solana is able to meet high demand, due to its ability to process more transactions per second, fees remain low.

What is SOL?

SOL is the native currency of Solana. It’s used to pay transaction fees, for staking, and gives its holders the right to vote in future upgrades. Of course, it can be used as a speculative asset, much like you would hold BTC or ETH. And, in theory, as a form of currency/payment for goods and services outside of the Solana network.

Should I invest in Solana (SOL)?

For starters, all cryptocurrencies are speculative investments, and we don’t suggest anyone begins trading without thorough research and a clear understanding of the risks. Crypto is about as volatile and unpredictable as it gets, as reinforced by the recent plunge in crypto markets.

However, the idea behind Solana is one that could make it a popular blockchain, and its native SOL token a valuable asset. Addressing scalability is crucial to a blockchain for real-world adoption. But there’s no guarantee it’ll be successful in its aims, and there’s no guarantee someone else won’t come along and do it better.

For all Solana’s talk of speed and scalability, it isn’t without issues or concerns.

For example:

It may be overinflated

Crypto hype can cause certain assets to skyrocket more or less on speculation. A great idea could revolutionise the world, and it could be worth billions in the future. That leads retail investors to pile in, hoping to get rich down the line. People are always on the hunt for the next Apple, Tesla, Microsoft, etc.

What Solana sets out to achieve could address one of crypto’s biggest roadblocks to widespread adoption. But then again, it might not.

It has technical issues

Solana has had some pretty big outages in the past. And some people are concerned that all this talk of speed is too much for the network. It’s still pretty new and hasn’t been road-tested. Solana says it can handle many transactions. But is it actually prepared?

There is concern Solana is too centralised

Decentralisation is the backbone of crypto. But some people feel Solana isn’t quite as decentralised as the rest, and for several reasons:

- Who owns its tokens?

As we mentioned above, SOL is the native token of Solana, and if you hold it, you get a say in the future of the project. Think of it as an apartment. If you own one apartment in a building of 100 apartments, you own 1% of the apartments and that gives you a vote. If you owned 20 of those apartments, you’d get more say.

Tokens work much the same way.

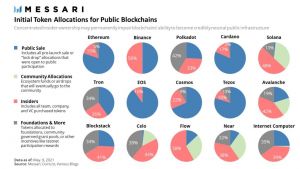

As you can see from this tweet below, almost half of all SOL tokens are held by Venture Capital investors, the developers, and the Solana Labs company, headed by its CEO Anatoly Yakovenko. Essentially, half the power is within the hands of a few. Which does sound somewhat centralised.

- There aren’t that many validators

Validators check the work being done and approve it. The fewer validators, the fewer people checking over it. Currently, Solana has a lot fewer nodes than Ethereum. It’s faster, but it’s more centralised.

- It’s susceptible to attacks

The Nakamoto Coefficient measures the number of validators (nodes) that would have to collude together to successfully slow down or block any respective blockchain from functioning properly.

For example, Bitcoin’s Byzantine Fault Tolerance design means 51% of the validators would have to be in agreement in order to make changes to the chain. With just about 14,409 nodes in the Bitcoin Network, according to bitnodes.io, it would take a Nakamoto Coefficient of 7349.

Solana’s Nakamoto Coefficient is just 19!

Subscribe to Brave New Coin

Boost your cryptocurrency and blockchain market intelligence. Brave New Coin’s suite of newsletters delivers curated crypto content for traders, analysts, investors and digital asset enthusiasts. From daily news and weekly wraps, to deep dive research and the latest market trends – click here to stay informed.

Boost your cryptocurrency and blockchain market intelligence. Brave New Coin’s suite of newsletters delivers curated crypto content for traders, analysts, investors and digital asset enthusiasts. From daily news and weekly wraps, to deep dive research and the latest market trends – click here to stay informed.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article