China news drags Bitcoin down

Bitcoin (BTC) markets slid back to around the US$35,000 price level over the last week. BTC ended the week down 10%, wiping out the previous week’s positive price performance. The second and third largest assets on the Brave New Coin market cap table, Ethereum (ETH) and Binance Coin (BNB) also end the week down, 12% and 8%, respectively.

Last Friday, the government and energy officials in Sichuan ordered the closure of 26 suspected cryptocurrency mining projects in the region. Most complied, and it appears to have had an immediate effect on Bitcoin block production times, with some blocks taking as long as an hour to be published over the weekend.

The Cambridge Centre for Alternative Finance (CCAF) currently records Sichuan as the 2nd largest Bitcoin mining province in China. Historically, Bitcoin miners have shifted operations to Sichuan during the middle of the year to take advantage of the cheap hydroelectricity available in the region during its wet season.

China’s ongoing pressure on cryptocurrency mining, which began last month, has already affected Bitcoin’s hash rate output and distribution. The network’s hash rate is down 27.9% since May 14th. Currently it sits at around 102 million terra hashes per second (TH/S) having been as high as 199 million TH/S mid-April.

Since last Friday, the Bitcoin price has dropped by 6%. Opinions differ on whether the price of Bitcoin follows its hash rate or vice versa. In the current context, its hash rate is dropping independently of price, because of the moves being made by Chinese regulators. The question for investors is whether this will now drag its price downwards, too.

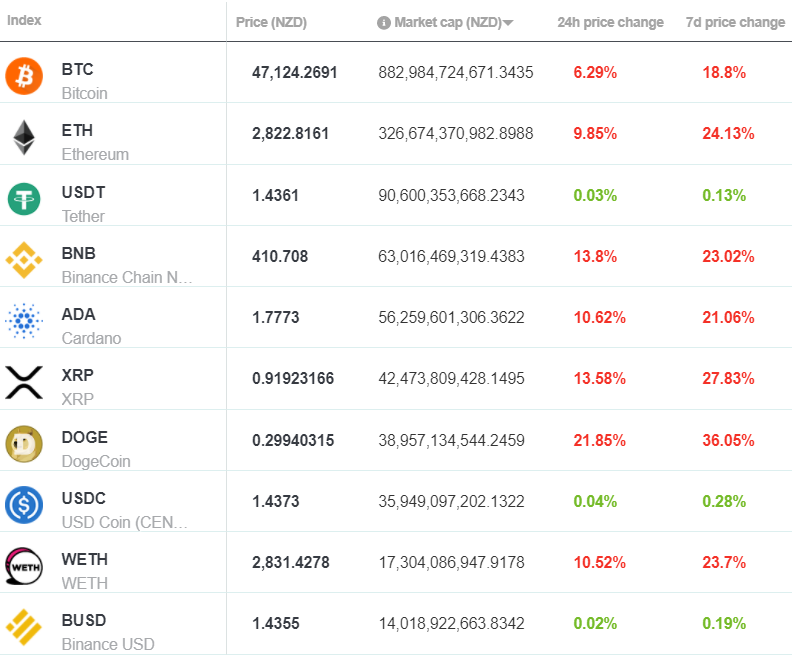

Market cap report

It’s been a difficult week for large-cap assets on the Brave New Coin market cap table. DOGE is one of the biggest losers, falling by 36% over the past seven days.

(Correct 22/06/2021 – 03:25 UTC)

For the full market cap rundown, click here.

Can Bitcoin go green?

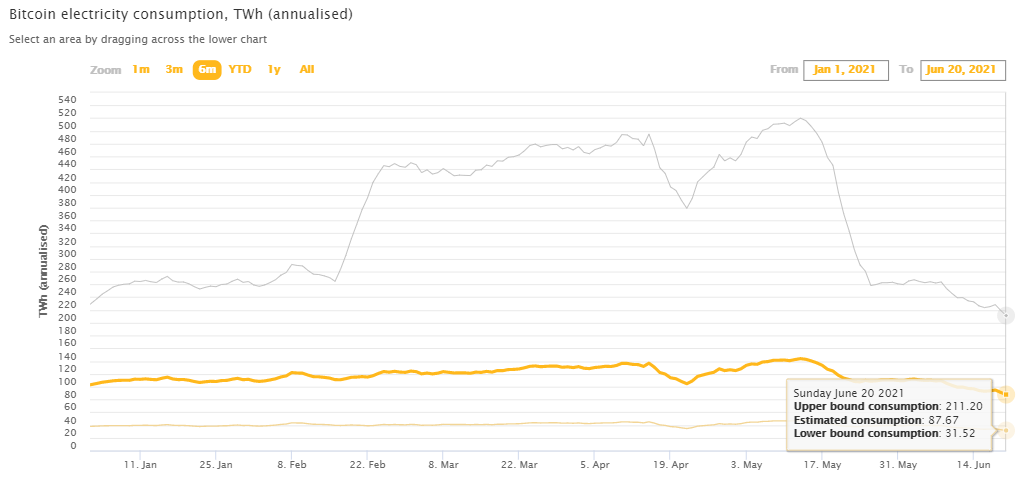

Understanding the real effects of Bitcoin’s energy consumption, and if it’s wasteful, is a complex subject. Up until recently, the CCAF estimated the Bitcoin network consumed around 120 Terawatt hours per year. This is about 0.52% of the world’s total consumption, and puts Bitcoin mining between the Netherlands and the UAE as a global electricity consumer. But the reality behind Bitcoin’s energy footprint is nuanced.

Source: Cambridge Centre for Alternative Finance

The Bitcoin mining and electricity equation

As a decentralized, secure payment network, the Bitcoin network is a breakthrough digital technology. But there is a downside. Securing the information and value stored on the network in a truly decentralized manner takes a great deal of processing power, which in turns required vast amounts of electricity. For the time being, there is no getting around that fact that Bitcoin uses a lot of electricity, and it always will. The question is if it can go green.

Push to a sustainable future

Given the reality of its energy consumption, where does this leave people like occasional Bitcoin evangelists Elon Musk and others, who, while fans of the disruptive potential of Bitcoin, are nonetheless concerned about the asset’s carbon footprint? If it’s a given that the Bitcoin network is going to continue to require large amounts of electricity to power fair, secure decentralization, could its electricity consumption be cleaner?

In answering this question, we have to remember that most Bitcoin miners are in it for the long haul, and have invested heavily in the technology. As such, it’s in their best interests to improve the carbon efficiency of the network to prevent Bitcoin from being targeted by government environmental agencies and their mining operations shut down.

A CCAF’s 3rd Global Cryptoasset study, published in September 2020, found that around 39% of proof-of-work mining was already powered by renewable energy, and that 76% of miners used renewables as part of their energy mix.

Bitcoin and China’s future

We already know that the majority of the hash power generated by the Bitcoin network is produced in Xinjiang, China. The region is a major coal mining hub, and so it’s likely that for most of Bitcoin’s existence, the hashrate produced in this region has been generated using coal.

But this is rapidly changing, as China develops wind farming in Xinjiang. While coal still dominates Chinese energy production, it currently accounts for around 65% of capacity – down from 79% in 2011. In the same time period, China has increased its total renewables (hydro, thermal, solar and wind) production by 50%, and has a goal of being carbon neutral by 2060.

And while it’s true that a carbon-neutral China in 2060 is still a long way off, it’s not when you factor in that at the current rate of production the final Bitcoin will not be mined until 2140.

So if Bitcoin production remains in China, its carbon footprint will decrease as the country implements more renewable energy sources. And, alternatively, if the alarmists are right and mining is outlawed in China, then there are still positives.

A greater global dispersion of hashrate will be good for the network in the long run, dispelling the myth that Bitcoin is controlled by China and moving its production to regions of greater environmental transparency and oversight.

Subscribe to Brave New Coin

Boost your cryptocurrency and blockchain market intelligence. Brave New Coin’s suite of newsletters delivers curated crypto content for traders, analysts, investors and digital asset enthusiasts. From daily news and weekly wraps, to deep dive research and the latest market trends – click here to stay informed.

Boost your cryptocurrency and blockchain market intelligence. Brave New Coin’s suite of newsletters delivers curated crypto content for traders, analysts, investors and digital asset enthusiasts. From daily news and weekly wraps, to deep dive research and the latest market trends – click here to stay informed.

Share this article