Thinking about credit card interest rates, fees and rewards can be complicated, so it’s completely understandable if you haven’t given a huge amount of thought to how the interest-free period works. The trouble is, the longer you go without mastering how to make the most of this credit card feature, the longer you’re potentially accumulating interest for no good reason. Below, we’ll take a look at how the interest-free period works in practice and what you need to keep in mind when putting purchases on the plastic.

What are interest-free days?

Credit and charge cards are often advertised as having a certain number of interest-free days – usually either 44 or 55 days interest-free. A common misconception is that 55 days interest-free means that you’ll have 55 days to pay off a card purchase before any interest is charged.

This number refers to the maximum number of interest-free days that are available. To get the full 55 days interest-free, you need to make a purchase on the first day of the statement period. This could be the first day of the month, or the monthly anniversary of when you first got the credit card (check your credit card statement for these dates).

Some credit card issuers will allow you to link your statement cycle to a preferred date. For example, if your home loan repayment is due on the 15th of each month, and you are paid fortnightly, you might prefer your credit card balance to be due on the 30th of the month, to evenly space out your two (possibly) biggest expenses.

If you’re trying to work out which credit card best suits your needs, use Canstar’s credit card comparison tools, to help you compare the options.

Compare credit cards with Canstar

Below, we’ll take a look in more detail at exactly how the interest-free period works for credit cards, using the 44-day interest-free period as an example.

How does a credit card interest-free period work?

The length of the interest-free period on an individual credit card purchase will depend on which day of your statement period the purchase is made.

Let’s assume that you’ve a credit card with 44 days interest-free and that your statement cycle runs from the 1st of the month to the 30th day of the month.

To help you see how the interest-free period works, we’ll use a hypothetical example of buying a fridge for $1000, but look at three different scenarios, depending on whether you made the purchase at the start, middle or end of the statement period.

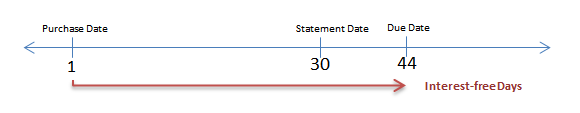

Purchase made on day 1

Total number of interest-free days: 44

Because you made the purchase on the first day of your statement period, you’ll receive the full benefit of the 44-day interest-free period. Be aware, though, if you don’t pay off the purchase in full by the due date, you’ll forfeit the interest-free period and get charged interest from day 1, until you pay it off. Usually, these charges appear on the 30th day of your next credit card payment cycle.

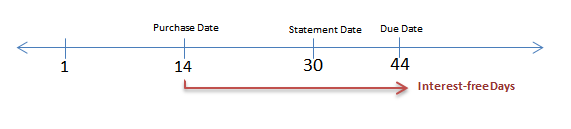

Purchase made on day 14

Total number of interest-free days: 30 (44-day interest-free period minus the number of days into the statement period that you made the purchase)

Because you made the purchase halfway through the statement period, you only have 30 days before you start getting charged interest. And, as in the first scenario, if you do not pay off the balance in full on the 44th day (the day your interest-free period ends) you start incurring interest charges.

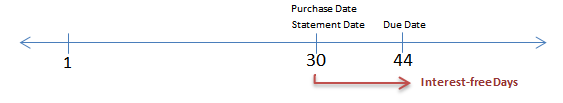

Purchase made on day 30

Total number of interest-free days: 14 (44-day interest-free period minus the day in the statement period that you made the purchase).

In this final scenario, you bought the hypothetical fridge on the final day of your credit card statement period (day 30). That means, you only have 14 days to pay off the purchase in full, before you start incurring interest.

If you had the option, let’s say your current fridge is working fine and you just want to upgrade, then it would make sense to delay buying it by one day, so that you’re buying it on the first day of your next statement period. This way, you receive the full 44 days interest-free (assuming you pay the closing balance on or before the due date).

Avoiding credit card interest charges

Regardless of whether you use your credit card for large one-off purchases, such as a new fridge, or if you use it for everything from daily coffees to utility bills, there’s only one way to avoid getting charged interest each month: pay the closing balance on or before the due date.

You can find details on your closing balance and credit card due date on your credit card statement. So, make sure you check it! If you know you have trouble keeping track of dates, try setting up a direct debit from a transaction account, so that you don’t miss any payments.

Here are some additional was to reduce or eliminate credit card interest:

- Always make more than the minimum repayment specified on your statement – every extra dollar will reduce your monthly interest bill.

- If you have an outstanding balance, don’t wait until the due date to make extra repayments. Making payments throughout the month will reduce the average daily balance of your card (this is the balance on which the interest calculations are based).

- Consider a balance transfer. Transferring your balance to another card at a lower rate for a period of time (perhaps even 0% p.a.) will allow you some breathing space to reduce and eliminate the debt. It’s not something to jump into without carefully weighing up the pros and cons, though.

- Regularly review whether your credit card type is working for you. If you know that you struggle to pay more than the minimum payment each month, but still require a credit card for purchases, then a low interest rate credit card is worth considering. Make sure you check which credit cards are available in the market, to see which one suits your spending profile. Canstar researches, rates and compares credit cards, to help you make an informed decision. Scan the credit card market in New Zealand, below.

Share this article