What is a credit card CVV?

If you’ve ever bought something online, then you’ve more than likely used your credit card’s CVV number, even if you don’t know exactly what that is.

CVV = Card Verification Value

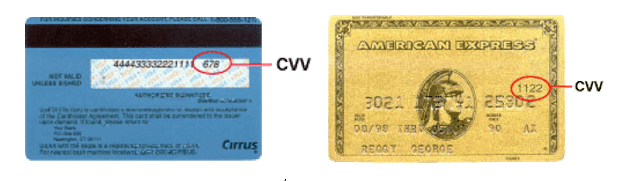

The CVV number is the three-digit combination on the back of your credit card, used to protect your finances from fraud and theft. It is 3 digits for MasterCard and Visa, while it is a four-digit number for American Express cards.

The CVV is an anti-fraud measure implemented by credit card companies to keep your shopping safe and secure, particularly when making online purchases. It is generally only used when a PIN or signature isn’t required, so you often won’t have to provide it in written form.

A CVV number is not the same as a PIN number that you use to make ATM withdrawals. But like a PIN number, it shouldn’t be disclosed to anyone but yourself.

Want more finance tips?

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Where do I find my credit card CVV?

As we mentioned earlier, the CVV on Visa, MasterCard and Diners Club cards has three digits, while American Express has four.

Picture source: www.strategicprofitsinc.com

You can see in the examples above where the CVV numbers are located; the Visa or MasterCard CVV is located on the back right, whereas the American Express CVV number is on the front just above the actual credit card number.

Why do I need a credit card CVV number?

You are required to enter the CVV number each time a payment is made that doesn’t require a signature. Since online transactions can’t easily be signed, this is where you’ll be using it the most. So if you’re someone who does a lot of online shopping or just loves the occasional eBay splurge, then you definitely need to keep your CVV number close by.

Every time you enter your CVV on a reputable site (with emphasis on the word reputable), it is transferred over a secure SSL connection, keeping your information safe.

If your card is lost or stolen, however, then thieves will still be able to use the card to make purchases since the CVV number is printed on the back, alongside the card number and expiration date. Therefore, you will still need to contact your cardholder immediately in order to cancel the card and cut said thieves off from the source.

Is it always called CVV?

Depending on the provider a CVV can occasionally go by other names. CVV numbers are also known as:

- CVC: Card Verification Code

- CVC2: MasterCard calls it this

- CID: Card Identification Number, often used by American Express

- CID 2: Discover

- CVV 2: Visa

Regardless of the varying names, each number serves the same function. The only potential difference is that codes with names that end in ‘2’ have been generated twice instead of once, making them harder to guess.

Can hackers access your CVV number?

The main purpose of a CVV number is to protect you from fraud, but they are not invincible. There are certainly ways that hackers that can gain knowledge of your CVV number and use it to make fraudulent purchases.

There are two ways that this is achieved:

Keyloggers

Keylogging is a concerning form of theft which involves hackers installing a virus or program onto an online merchant’s website and duplicating all the credit card data that is submitted there. The keylogger captures this data before it is encrypted on the site, and bundles all of it into packages. Fraudsters then purchase packages of this data and sell it at a premium.

Phishing scams

The more common form of online theft is a more straightforward yet deceptive method – phishing. If you’ve ever received a slightly suspicious email from someone pretending to be a bank or financial institution asking you to send them money or submit your credit card details, then you know what phishing is. Phishers usually make their emails and texts look as much like the company they’re imitating as possible, but if you look closely you can mostly see some missing details.

Credit card scams are becoming more and more common, but there are some simple precautions you can take to ensure you don’t fall victim to one. Always use anti-virus software on your phone and computer, and if the website you’re on looks off, then check the site’s SSL certificate. If you see a padlock symbol, you should be confident the site is safe. You should also strive to use reputable payment services such as PayPal whenever possible.

Want more finance tips?

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article