Car insurance: what isn’t covered

Most comprehensive insurance policies share common exemptions that limit coverage. Below we list the general exemptions found in most policies, however, they do not cover all the exclusions you may find in your policy. So as with all insurance products, it's important to read your policy's product disclosure statement (PDS) so you fully understand your level of cover.

Mechanical or electrical breakdowns

If your car fails its WOF, don’t expect your insurance provider to cover any repair costs.

Comprehensive car insurance covers accidents, fire and theft, and not mechanical or electrical faults and breakdowns. So, if your car fails to start and needs repairs, you will have to pay for them yourself.

Using your car outside of what is expected

Most policies only cover vehicles if they are driven on the road and to the letter of the law. If you use your car illegally, or off-road, and are involved in an accident you're unlikely to be covered.

Examples of usage exemptions include:

- Driving your vehicle for business purposes (unless specified)

- Using your vehicle for criminal purposes

- Racing or doing burnouts

- Off-road driving, such as on beaches, dunes, across rivers and hill-climbing

Driving when you are not supposed to

If you shouldn’t be driving, don’t. For example, don't expect your insurance company to pay out in the event of a claim if you have an accident while:

- Driving without a licence/on an expired licence

- Driving between 10pm and 5am on a restricted licence (without a supervisor)

- Carrying passengers on a restricted or learner's licence (without a supervisor)

Driving under the influence

This one is hardly surprising. No matter how much you’re paying in premiums and excess, no insurer will cover you if you drive under the influence of drugs or alcohol. Additionally, if you have an accident and refuse a blood or alcohol test, your insurer will not cover you, either.

It’s important to note that driving under the influence also applies to prescription medication if it impairs your ability to drive safely and you've been notified not to drive while taking it.

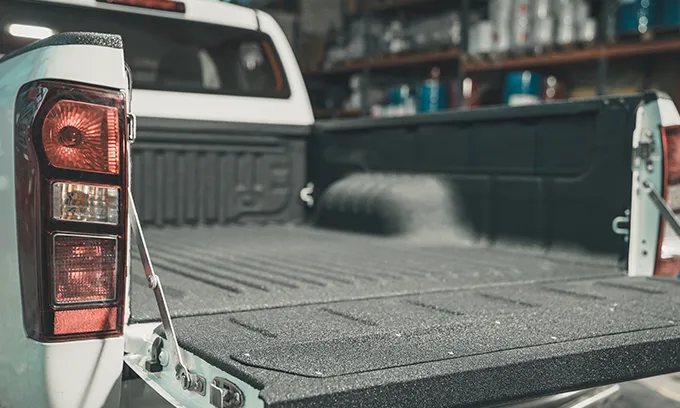

Your vehicle is unroadworthy or overloaded

It’s simple: no WOF or rego = no cover.

If your car's not roadworthy it will not be insured. Additionally, if you're carrying an illegal number of passengers for your vehicle, or have heavily overloaded your car (or not secured a load safely) your insurance will not cover you.

Gradual deterioration

Car insurance is designed to cover you financially in the event your car is stolen, damaged or destroyed. It does not cover you for gradual damage that could occur over time. Examples of this include:

- General wear and tear

- Damage as a result of pests

- Damage and wear to tires

- Rust

- Mould and mildew

However, resulting loss may be covered. Resulting loss refers to secondary damage that occurs as a direct result of certain gradual deterioration. Check your insurance policy to see if you're covered for resulting losses.

Consequential costs

While your car insurance will cover the cost of repairing your vehicle in the event of an accident, it will not cover any consequential costs. These can include:

- Legal costs (although some policies may provide legal cover)

- Expenses, liabilities or loss of income due to the loss of your car

- Time, travel, and inconveniences taken to assist with a claim

Unspecified modifications

While you can put some new rims on your vehicle without any worries, any significant modifications made need to be declared to your insurer, who may not agree to cover your mods.

However, if you don’t declare any modifications, you could find, come time to make your claim, your insurance is worthless.

Common modifications that you should report to your insurer include:

- Changes to the engine, steering, suspension or chassis

- Performance enhancements, structural changes, or a non-standard exhaust

- Changes to the computer or fuel system

- Changes to electrical equipment

Intentional damage or recklessness

Any acts that are intentional, reckless, deliberate, malicious or have criminal intent, will cause your cover to be voided.

Additionally, illegally leaving the scene of an accident will veto your cover.

Impounded

If your car is impounded or confiscated, your insurance will not cover any costs associated with its return. So pay your parking tickets!

The far-fetched

Car insurance policies do not provide cover in the unlikely event of war, terrorism, or damage as the result of nuclear contamination and radiation.