Are you still suffering from the hangover of your student days? No, not the type you get from impromptu study sessions at the university bar. We’re talking student loan debt hangovers, another headache-causing activity of student life.

Student loan repayments are a fact of life for anyone who has borrowed money to fund their education. So, regardless of whether you hit the books – or the beers – hard, you have to find a way to pay back the money.

However, there is light at the end of the tunnel. So, settle in for a study session of the financial kind, so you can reap the rewards of wiping clean your student loan debt.

How do student loan repayments work?

Student loan repayments are automatically deducted from your salary. So, as long as you are working (in New Zealand) you will be paying back your student loan. How much you pay back each week depends on your salary.

According to Inland Revenue, you pay 12% of every dollar (12c) you earn above the repayment threshold. The thresholds can be seen below:

| If you’re paid… | Your repayment threshold is… |

| Weekly | $390 |

| Fortnightly | $780 |

| Four-weekly | $1560 |

| Monthly | $1690 |

This means that for the first $390 you make a week, no repayments are made. Anything above this will have a 12% deduction. So your salary will play a big role in how quickly you can pay off your student loan. For example:

| Weekly Salary (before tax) | Deductable Salary (remaining salary above $390 weekly threshold) | Weekly student loan repayments |

| $1000 | $610 | $73.20 |

| $800 | $410 | $49.20 |

| $600 | $210 | $25.20 |

As you can see, if you earn a $600 salary, and pay just $25.20 a week towards your student loan, then you’ll likely be stuck paying it for years to come. So, it may be wise to start thinking about how you can pay it off faster.

What if I am working overseas?

If you are working overseas, your student loan repayments become a little more complicated. In this case, they are not deducted from your salary. Instead, you are required to make minimum repayments twice a year. The due dates for thee payments are:

- 31st March

- 30th September

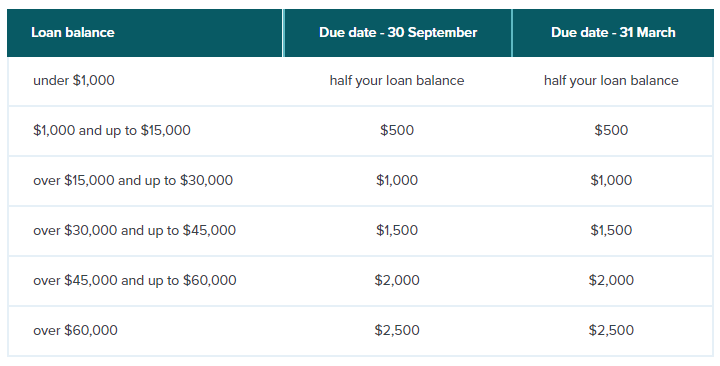

By each of these dates, you must have made at least the minimum payment required (you are welcome to pay extra). The minimum required amount is dependant on your loan balance:

Keep in mind that when based overseas, your student loan is charged interest (currently 3%). The minimum repayments listed above are enough to cover this interest and, so long as your balance is below $142,860, will also pay off some of the loan amount. But, by living overseas you will be extending the life of your loan.

For more information around your student loan obligations when living overseas be sure to visit the ird website.

How to pay off your student loan faster

The only way to pay off your student loan faster is to make extra repayments. Well … that or get a higher paid job in order to up your automatic deductions. But while paying off your debt is nothing but positive, it’s important to weigh up the pros and cons of making extra repayments. After all, any repayments will come at the expense of money in your pocket now, as well as other investments you may want to make.

So, there is plenty to consider before you make any extra payments:

Do you need money now?

If you don’t have much expendable income, it may be worth letting those automatic deductions take their course, and not bother with extra repayments.

So long as you are working and, little by little, chipping away at your debt, then that may be best for your situation. Sometimes the option that costs the least in the immediate term is best. Especially in this case, as you can’t withdraw extra student loan repayments. So if you do make extra repayments, make sure you won’t need that money back!

It’s also important to remember that your student loan balance doesn’t grow. Due to inflation, the value of your loan actually depletes with time. Just think what $20 could buy ten years ago compared to now. Likewise, a $10,000 student loan will be less intimidating ten years down the road.

On the other hand, the moment you pay off your loan you get back those 12 cents per dollar you have been losing. Which will be a big boost to your weekly income. So, if you do have enough expendable income, some extra repayments may not be a bad idea.

Do you plan on buying a house in the near future?

When applying for a mortgage, lenders will take into consideration your ability to afford it. And, as part of that they will assess your current debts, student loan included. Even if you can’t pay off your entire debt before applying, the smaller the debt the better.

Do you have other debts?

Your student loan debt is a bit of an anomaly in that it’s interest-free. Most debts aren’t. If you have any other debts, such as credit cards or personal loans, then paying off your student loan should be at the bottom of the list.

Are you moving overseas?

When based overseas, the amount you have to pay towards your student loan each year depends on your overall balance. For example, if your student loan is above $30,000, you have to make $3000 a year in minimum repayments. If it’s under $30,000, that drops down to just $2000.

So if your current balance is just above a threshold, say $32,000, it could be worth trying to knock it below the $30k mark before those overseas payments kick in.

What else could you use the money for?

If you decide to cut out a few luxuries and put that money towards your student loan, then good on you. But, if paying off your student loan comes at the expense of savings and other investments, it pays to think a little more carefully. Because your student loan is interest free, and there are no annual fees, it isn’t costing you anything. So it may be wiser to use your extra cash for investments that have the potential to actually grow your money.

Additionally, any extra money put towards your savings or other investments can easily be taken back. You can always cash in your shares or withdraw your savings. Even term deposits only lock away your funds for a year or two at a time.

But once put towards your student loan, your money is gone. If you do decide to make extra repayments, make sure it’s not stretching your budget too thin.

→Related article: Guide to Online Share Trading Apps

Some tips for wiping your student loan debt

People do pay off their student loans

Don’t believe people who say it’s impossible to pay back a student loan. In fact, almost 50% of Kiwis who have taken out student loans have finished paying them back! That’s according to the latest Student Loan Scheme Annual Report, which states of the 1.37 million student loans taken out since the scheme began in 1992, 660,000 of them have been fully paid back.

If you want to figure out how long it will take you to pay off your loan, check out this calculator from the IRD.

Little by little

The way to look at debt is that paying off a little means a lot in the long run, so start with baby steps. As the saying goes, you eat the elephant one bite at a time. The same goes for debt – paying off $10 here and there will add up to a lot over a year. And you can free up some extra cash to put towards the debt simply by reassessing your spending.

About the author of this page

This report was written by Canstar Content Producer, Andrew Broadley. Andrew is an experienced writer with a wide range of industry experience. Starting out, he cut his teeth working as a writer for print and online magazines, and he has worked in both journalism and editorial roles. His content has covered lifestyle and culture, marketing and, more recently, finance for Canstar.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article