ASB’s new digital tool gives its KiwiSaver members the ability to see how small changes to their contributions and choice of funds can make a big difference to their returns, and then access personalised advice so they can hit their investment goals. Its unique approach to KiwiSaver advice makes it a worthy winner of one of Canstar’s latest Innovation Awards.

What is ASB’s KiwiSaver Digital Advice & Projections Tool

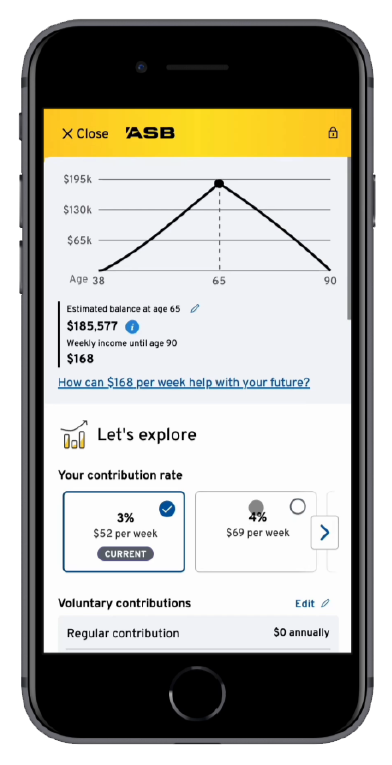

ASB’s award-winning digital KiwiSaver advice and projections tool allows the bank’s KiwiSaver members to see easily and clearly how changes to their contribution levels and fund choices can make big steps towards reaching their investment goals. It also offers a unique approach to offering personalised KiwiSaver advice.

Reaching out for financial advice can be daunting. Indeed, over 80% of Kiwis have never received any investment guidance. This is despite the fact that it can help deliver higher returns and significantly larger KiwiSaver balances.

However, ASB knew from its research that its customers were interested in discovering how their contributions could affect their first home or retirement lifestyle goals. So within this context they set about creating a digital tool to better help people achieve their KiwiSaver goals.

Rather than offering specific advice from the get-go, ASB’s new digital tool first lets users explore their own KiwiSaver options. The simple-to-use interface allows ASB KiwiSaver members to track their potential investments across the range of available fund types and contribution levels.

It reveals the tangible impacts of their KiwiSaver choices on their future lifestyle goals. And then, only at the end, does it offer the option of tailored investment advice for users considering changes to their KiwiSaver.

As a result of its new tool, thousands of ASB customers have received personalised KiwiSaver fund advice, helping them on the path to brighter and more secure financial futures.

What are Canstar’s Innovation Excellence Awards

Canstar’s Innovation Excellence Awards reward the best and most innovative financial products to come to market over the past 12 months. All submissions and nominations for the 2024 Innovation Excellence Awards were judged and assessed by Canstar’s expert research committee using our sophisticated and unique ratings methodology.

Products and services assessed were measured and calculated against two factors:

Degree of innovation:

- How unique is the product?

- How disruptive is the innovation?

- Does it have a WOW factor?

Impact:

- How many customers does it benefit?

- Is it affordable and easy to use?

- How will it improve and affect a consumer’s life?

All these factors were scored on a rating from one to five, and then weighted to produce a final score. The degree of innovation is weighted at 40% and a product’s impact is weighted at 60%.

You can learn more about the evaluation and calculation details in our awards methodology, here.

What our judges said about ASB’s digital KiwiSaver tool

Recognising that a significant portion of Kiwis are unsure about their retirement readiness, and that many have not accessed professional financial advice, our awards panel commended the way that the ASB has seamlessly integrated the provision of digital advice into their KiwiSaver projections tool to make financial advice more accessible and tailored to individual needs.

The judges recognised that ASB’s proactive and unique approach to providing financial advice is helping to change the status quo by enhancing user engagement and making advice more accessible to a broader audience at no extra cost.

About the author of this page

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce has three decades’ experience as a journalist and has worked for major media companies in the UK and Australasia, including ACP, Bauer Media Group, Fairfax, Pacific Magazines, News Corp and TVNZ. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

Share this article