This year, American Express won Canstar’s prestigious award for Most Satisfied Customers | Rewards Credit Cards for the fourth consecutive year. And for good reason. Amex’s range of rewards cards offers great perks, especially for high flyers and lovers of fine cuisine.

American Express’ Airpoints cards all earn top 5-Star ratings for Outstanding Value. While users of Amex’s Gold Rewards Cards can indulge in a great dining credit that gives them a $100 cashback when they spend $100 or more in one transaction at participating restaurants (valid twice a year).

However, now American Express card holders can enjoy even bigger rewards bonuses, thanks to the American Express Dining Collection and the Amex Shop Small Initiative.

American Express Dining Collection

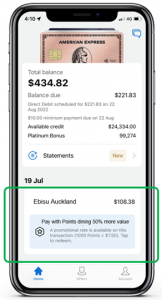

American Express diners who pay for their meals using their rewards points at participating restaurants across the country will find their points worth 50% more.

American Express diners who pay for their meals using their rewards points at participating restaurants across the country will find their points worth 50% more.

The increased value is ongoing and valid on transactions made from 1/7/22. It’s an excellent way to support our hospitality industry and experience some of New Zealand’s top restaurants.

To make use of the American Express Dining Collection deal, just dine at any of 85+ top NZ restaurants nationwide, and simply pay for your meal by opening the Amex App. Then select the Dining Collection transaction and opt to “Use Points”.

Regular Pay with Points conversions work out to: 30,000 points = $150. However, Dining Pay with Points conversions provide even greater value: 30,000 points = $225.

For more details and the full list of participating restaurants, click here.

Shop Small NZ

Shop Small celebrates the importance of small businesses, and encourages Kiwis to support small business owners as they work to recover from the effects of the pandemic.

Running until the end of November, Amex’s Shop Small initiative involves over 20,000 small businesses across New Zealand. By registering online, an American Express member with an eligible card will enjoy a special offer while supporting small and local businesses.

Just spend $10 or more and get a $5 credit on your account, up to 10 times – that’s a total of $50 back!

For more details of the American Express Shop Small initiative, click here.

Winner of Most Satisfied Customers | Rewards Credit Cards: American Express

American Express’ range of rewards credit cards covers all budgets and personal finance requirements:

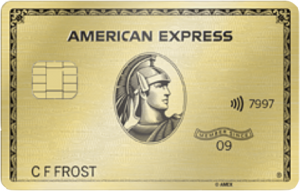

Gold Rewards Card

Features:

- Metal card in gold or rose gold

- $200 back if you spend $1500 on your card in the first three months of membership

- Earn 2 Membership Rewards points per $1 spent

- Dining credit: $100 back when you spend $100 or more in one transaction at a participating restaurant.

Valid twice a year. Exclusions, T&Cs apply. - Add up to four additional card members for free

- Up to 55 days interest free

Fees and charges:

- $200 annual fee

- Minimum income $50,000

- Purchase interest rate: 22.95% p.a.

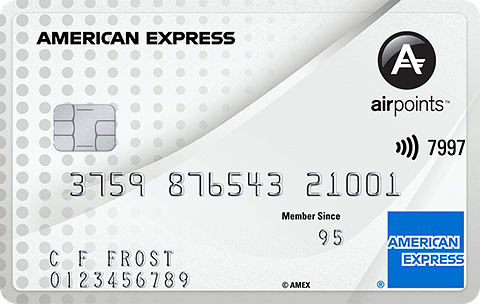

Airpoints Card

Features:

- 50 Bonus Airpoints Dollars on sign-up if you spend $750 on your card in the first three months of membership

- Earn 1 Airpoints Dollar for every $100 you spend on eligible purchases

- Add up to four additional card members for free

- Up to 55 days interest free

Fees and charges:

- No annual fee

- Minimum income $35,000

- Purchase interest rate: 0% p.a. for the first 6 months, 22.95% p.a. thereafter

Airpoints Platinum Card

Features:

- Earn 1 Airpoints Dollar for every $59 you spend

- 300 Bonus Airpoints Dollars on sign-up if you spend $1500 on your card in the first three months of membership

- Complimentary domestic and international travel insurance when you pay for travel on your card

- Koru Lounge Discounts

- Smartphone cover: pay for your smartphone outright or pay your monthly smartphone contract or plan on your card, and you’ll be covered for up to $500 towards front screen repairs (10% excess applies)

- Add up to four additional card members for free

- Up to 55 days interest free

Fees and charges:

- $195 annual fee

- Minimum income $65,000

- Purchase interest rate: 22.95% p.a.

Compare credit cards with Canstar

If you’re looking for a new credit card, then let Canstar be your guide. Perhaps you want one with a low interest rate, or low fees, or want to swap your rewards card from points to cash. Our free credit card comparison tool compares all the major cards in the market and awards the best our prestigious Star Ratings. For more information on credit cards and to compare further, just click on the big button below.

Compare credit cards with Canstar here!

About the author of this page

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce began his career writing about pop culture, and spent a decade in sports journalism. More recently, he’s applied his editing and writing skills to the world of finance and property. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce began his career writing about pop culture, and spent a decade in sports journalism. More recently, he’s applied his editing and writing skills to the world of finance and property. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

Enjoy reading this article?

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article