When you’re looking for a new car, whether new or used, you may want to sell your old car at the same time. But is trading in your old car a better option than selling it separately when it comes to the value you might receive? Canstar takes a look at some of the factors that can affect the trade-in value of a car.

What is the trade-in value of a car?

A trade-in value is the amount that a dealer is willing to offer you towards the purchase of a new car in exchange for your current vehicle. It’s typically based on the market value of your car, which is the amount it would sell for on the open market.

Trade-in values vary depending on many factors, such as the popularity of the make and model of a car, its age and condition, and how many similar cars a dealer already has on their lot.

But, in general, a dealer's offer will be far less than you could achieve through a private sale. There are a few websites, such as Trade Me, that offer a rough estimate of how much your car might be worth, based on the make and age of the vehicle and the distance it has on the clock.

Pros and cons of trading in a car

While a private sale is likely to get you the best price for your old car, trading it in does have potential benefits:

Potential benefits of trading in a car

- A dealer trade-in is generally a quick and convenient option, as you avoid the need to advertise your vehicle and meet with potential buyers.

- Trading in may offer a more straightforward solution, particularly if your car is a common model, requires repairs or has a lot of kilometres on the clock, as you can avoid having to spend time and money preparing it for sale. Although dealers are likely to deduct the cost of any repairs required from the price they offer for your vehicle.

- Trading in your old car, as with selling your car privately, can mean lowering the amount you need to pay for your new vehicle. This can reduce the amount you need to borrow if you require finance.

Potential drawbacks of trading in a car

- A private sale can achieve the best price for your vehicle, as dealers won’t necessarily offer you the full value of your car, as they'll need to on-sell it for a profit. This can be particularly true if your current vehicle is a recent model, or one that's in high demand.

- Trading in a car will limit your ability to bargain down the price of the new vehicle you wish to purchase.

- In some cases, a dealer may decline to buy your car, particularly if it is old or in low demand.

Trading in your car with finance owing

If you’re thinking of trading in your car before the end of your loan term, you need to talk to your lender and the car dealership you’re using for the trade-in.

Depending on your lender, and the terms of your car loan, it may not be possible to trade in your vehicle if there is outstanding debt on it. However, you may be able to refinance your loan using your new vehicle as security.

→ Buying a car? Compare car insurance with Canstar

How to get the best trade-in value

- Take care of your car. Consider getting it serviced regularly and ensure each service is recorded in the car’s logbook as proof of maintenance.

- Make repairs as necessary. If something doesn’t seem right with your car, don’t just ignore it, because the dealer probably won’t.

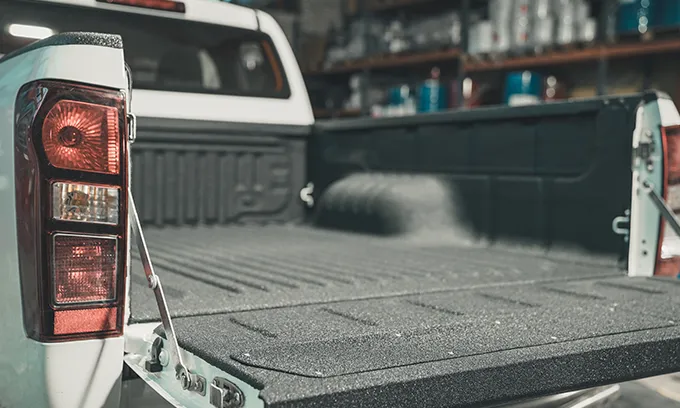

- Keep the car clean. Especially when you take it in to the dealership, ensure that both the inside and the outside of the car are clean and well maintained. First impressions count.

- Do your research. Find out what your car may be worth and how much other vendors are asking for similar cars. Knowing the true value of your car will allow you to spot if a dealer's trade-in offer is fair.

- Shop around for the best deal. Consider visiting a few different car dealerships so you can compare what they are willing to offer for your trade-in.