What are road user charges?

Anyone using New Zealand’s roads contributes towards their upkeep through taxes.

Petrol vehicle users pay through levies on petrol, while drivers of heavy vehicles (over 3.5 tonnes gross laden weight) and all diesel vehicle drivers pay through road user charges (RUCs).

Owners of pure electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) are also required buy and display RUC licences.

RUCs allow the government to charge big lorries, buses and trucks higher levies, as they cause more wear and tear on our roads: the heavier the vehicle, the bigger the RUC.

RUCs are based on the distance a vehicle travels. RUC licences are priced in units of 1000km and must be displayed on a vehicle's windscreen.

Note that the government has announced plans to remove levies on petrol altogether, and introduce RUCs for all vehicles. The details of the new RUCs are still being worked out, but the new scheme is set to be introduced in 2027.

Road user charges for EVs & PHEVs

Since last year, all EV and PHEV owners have been required to purchase RUC licences.

The RUC rate for EVs is the same as for diesel vehicles: $76 per 1000km unit.

Because PHEV users also pay for petrol, the RUC rate for PHEVs is lower: $38 per 1000km unit.

How much is the road user charge?

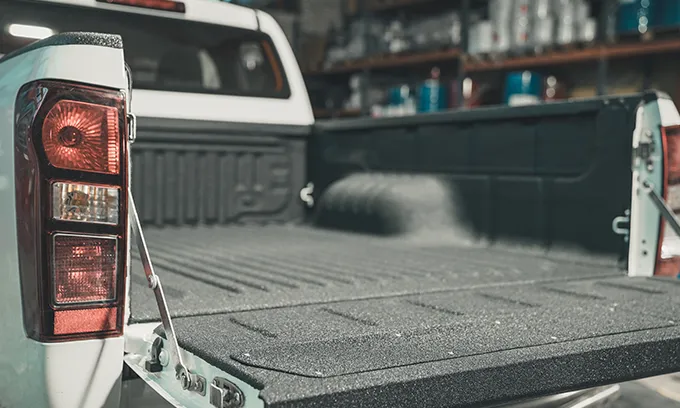

RUCs vary depending on a vehicle's weight and its number of axles. Here's an overview of RUCs for common powered passenger vehicles with two axles, including EVs, utes, vans and lightweight petrol vehicles.

Weight Bands | RUC rate per 1000km |

Up to 3500kg | $76 |

3501kg - 6000kg | $82 |

6001kg - 9000kg | $167 |

Any RUC weight over 9000kg | $352 |

As we mention above, the rate for PHEVs is lower: $38 per 1000km unit.

The RUC rates for large truck-trailers, buses, unpowered vehicles, motor caravans and vintage vehicles can be found here.

Note that an administration fee applies to all types of RUC licences:

- Online – $12.44

- Instore counter sales – $13.71

How do I buy road user charges?

You can buy a RUC licence either in store or online.

To purchase a RUC online, follow these steps:

- Follow this link to the Waka Kotahi NZ Transport Agency website

- Fill in your name, plate number and number of units you need (each unit is 1000km)

- Enter your internet banking details, or use a Visa or Mastercard credit/debit card to pay

- Confirm transaction

You can purchase a RUC licence instore at any:

- Automobile Association (AA)

- Postshop

- Vehicle Inspection New Zealand (VINZ)

- Vehicle Testing New Zealand (VTNZ)

- Independent agents that display the Waka Kotahi logo

How is my distance recorded?

Every vehicle that requires an RUC licence must be fitted with an approved electronic distance recorder or hubodometer. If you drive an EV, PHEV, diesel car, ute or other small vehicle, the distance recorder will be your regular odometer.

However, vehicles over 3.5 tonnes require an approved hubodometer or electronic distance recorder. A list of approved distance recorders and hubodemeters can be found here.